Key Takeaways

- Gain a strategic advantage by capitalizing on forex session overlaps, particularly the high-liquidity London-New York window.

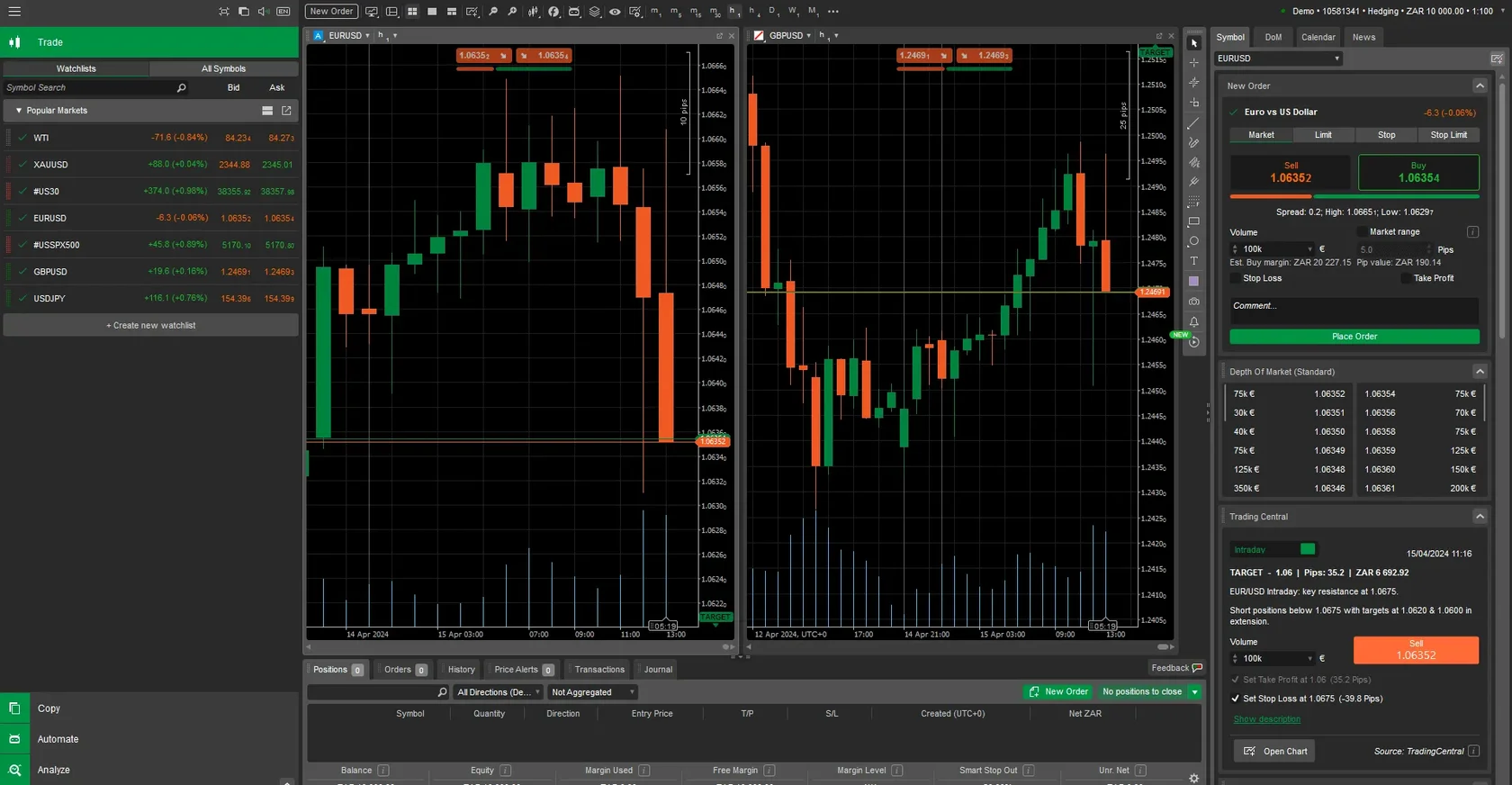

- Leverage powerful platform tools for session-specific alerts, in-depth analysis, and robust risk management.

- Enhance your trading strategies and control risk more effectively by mastering the dynamics of each session.

Table of Contents

- Understanding Global Forex Market Sessions

- Optimal Trading Times for South African Forex Traders

- Currency Performance Across Major Forex Trading Sessions

- Platform Features for Session-Based Trading

- Risk Management Across Trading Sessions

- Economic Events and Session Impact

- Technology Infrastructure for Session Trading

- Advanced Session Trading Techniques

Understanding Global Forex Market Sessions

The foreign exchange market operates 24 hours a day, five days a week, across several Major Forex Trading Sessions. For South African traders, this continuous market access offers a unique strategic position between the European and Asian markets. Our platform grants you seamless entry to all sessions, complete with real-time data and sophisticated analysis tools.

The cycle begins with the Sydney session at 7:00 AM SAST, followed by Tokyo at 9:00 AM SAST. The highly influential London session kicks off at 10:00 AM SAST (during winter), and the dynamic New York session starts at 4:00 PM SAST. Each of these periods presents distinct market characteristics and profitable trading opportunities.

Market volatility fluctuates significantly between sessions. While Asian sessions are often characterized by lower volatility and steady price action, the European session injects a surge of activity. The overlap between the London and New York sessions generates the highest trading volume and volatility globally, creating a prime environment for traders.

| Trading Session | SAST Opening Time | Peak Activity Hours | Average Daily Range |

|---|---|---|---|

| Sydney | 7:00 AM | 7:00-10:00 AM | 50-80 pips |

| Tokyo | 9:00 AM | 9:00 AM-12:00 PM | 60-90 pips |

| London | 10:00 AM | 10:00 AM-2:00 PM | 80-120 pips |

| New York | 4:00 PM | 4:00-8:00 PM | 90-150 pips |

Optimal Trading Times for South African Forex Traders

South African traders can leverage strategic advantages during specific session overlaps. The London-New York overlap, from 4:00 PM to 6:00 PM SAST, is the most liquid period of the trading day. Our platform pinpoints these optimal windows with automated alerts and offers enhanced spreads to maximize your potential.

European Session Benefits

The London session aligns perfectly with South Africa's morning hours, making it ideal for local traders. Pairs like EUR/USD, GBP/USD, and USD/CHF exhibit their highest activity during this time. We provide specialized tools and reduced spreads for European currency pairs during these peak hours.

Major economic releases from the European Central Bank occur during active South African trading hours. Our integrated economic calendar and automated news feeds deliver real-time updates directly to your trading interface, ensuring you never miss a market-moving event.

Session Overlap Strategies

The Tokyo-London overlap (10:00 AM - 12:00 PM SAST) presents opportunities in moderately volatile conditions, especially for JPY-related pairs. Our platform features specific indicators designed to help you execute effective overlap trading strategies.

Be prepared for directional shifts during session transitions. We provide transition alerts thirty minutes before each session change, complete with volatility forecasts and recommended position adjustments to keep you ahead of the market.

Currency Performance Across Major Forex Trading Sessions

Different currency pairs exhibit optimal performance during specific trading sessions. To succeed, traders must understand these performance patterns. Our analytical tools track historical data across all Major Forex Trading Sessions to give you a clear advantage.

EUR/USD typically dominates during London hours, with average daily ranges often exceeding 100 pips. GBP/USD follows a similar pattern, with volatility spiking during UK economic announcements. Meanwhile, USD/JPY performs best during the Tokyo-London overlap.

Commodity currencies like AUD, NZD, and CAD are most active during their respective regional sessions. For instance, AUD/USD sees peak activity during Sydney hours. Our platform provides currency-specific session indicators to help you perfect your entry timing.

Use these performance characteristics to guide your strategy:

- Asian sessions favor range-bound strategies with JPY pairs.

- European sessions are ideal for trend-following approaches with EUR and GBP pairs.

- American sessions often benefit breakout strategies involving USD pairs.

- Overlap periods create prime conditions for scalping techniques across major pairs.

Platform Features for Session-Based Trading

Our trading platform is equipped with a suite of session-specific tools engineered for South African traders. The session clock displays active sessions with countdown timers, while color-coded indicators highlight transitions and overlaps, so you're always in sync with the market.

Automated Session Alerts

Our custom alert system notifies you of upcoming session changes via email, SMS, and mobile push notifications. This ensures you're informed about critical market events, even when you're away from your desk. Customize alerts by currency pair and volatility thresholds to match your trading style.

Session-Based Analysis Tools

Gain an edge with technical indicators that automatically adjust to active trading sessions. Moving averages recalibrate for session-specific timeframes, and Bollinger Bands expand their parameters during high-volatility overlaps. Our integrated economic calendar highlights relevant news, with impact ratings to help you prioritize.

Risk Management Across Trading Sessions

Effective risk management requires adapting your approach to each session. The lower volatility of Asian sessions may permit tighter stop-losses, whereas the increased price swings of European and American sessions demand wider stops to avoid premature exits.

Our risk calculator helps you make informed decisions by incorporating session-specific volatility into position sizing recommendations. It also allows you to scale maximum drawdown limits according to expected session ranges.

| Risk Parameter | Asian Session | European Session | American Session | Overlap Periods |

|---|---|---|---|---|

| Stop Loss Range | 15-25 pips | 25-40 pips | 30-50 pips | 20-35 pips |

| Position Size | Standard | Reduced 20% | Reduced 30% | Standard |

| Max Daily Risk | 2% | 1.5% | 1.2% | 2.5% |

Session-Specific Stop Loss Strategies

Trailing stops perform differently across various sessions. Tighter trailing distances are effective during Asian consolidation periods, while wider parameters are better suited to European trending movements. Our platform offers session-adaptive trailing stop algorithms that automatically adjust to current market characteristics, with manual override available for full control.

Economic Events and Session Impact

Major economic announcements are a primary driver of session dynamics. Decisions from the European Central Bank can dramatically affect London session volatility, while communications from the Federal Reserve substantially impact New York trading ranges.

High-impact data like the Non-Farm Payrolls report creates exceptional volatility during American sessions. Our platform helps you navigate these periods by automatically widening spreads and implementing pre-event position limits to manage your exposure.

Pay special attention to these economic events during their respective sessions:

- Central bank interest rate decisions.

- Employment data releases.

- Inflation reports influencing monetary policy.

- GDP announcements impacting long-term currency trends.

News Trading Strategies

Our news trading tools provide real-time economic data feeds and consensus forecasts. Set deviation alerts to be notified when actual results differ significantly from expectations, and use our historical impact data to guide your position sizing decisions.

Technology Infrastructure for Session Trading

Our robust trading infrastructure operates across multiple global data centers to ensure reliability. Latency optimization guarantees consistent execution speeds during all sessions, while redundant connections maintain platform stability during peak trading hours.

With servers in London, New York, and Singapore, we provide regional optimization for traders worldwide. South African clients benefit from dedicated fiber connections, achieving average execution speeds below 50 milliseconds across all sessions.

Mobile Trading Capabilities

Our full-featured mobile app provides complete session monitoring capabilities. Manage orders, view real-time charts, and stay connected to the markets from anywhere. Offline mode and battery optimization ensure you never lose your connection to the trading world.

| Technology Feature | Specification | Session Benefit |

|---|---|---|

| Execution Speed | <50ms average | Optimal fills during volatility |

| Data Updates | Real-time streaming | Current session information |

| Mobile Sync | Instant synchronization | Continuous session monitoring |

| Backup Systems | 99.9% uptime | Reliable session access |

Advanced Session Trading Techniques

Professional traders employ sophisticated strategies tailored to specific sessions. Carry trade positions, for example, benefit from interest rate differentials across time zones, and our platform automatically calculates overnight financing costs for you.

Arbitrage opportunities can emerge during session transitions. Our advanced scanning tools identify these brief windows, while our execution algorithms optimize order timing for maximum advantage. Furthermore, session momentum strategies allow you to capitalize on directional movements during peak hours.

The platform supports complex, multi-session strategies through advanced order types like contingent and time-based orders. A deep understanding of the Major Forex Trading Sessions is what enables strategic, profitable trading decisions. Our comprehensive tools and educational resources are here to help you master the markets.

FAQ

- What are the major forex trading sessions for South African traders?

- The major sessions are Sydney, Tokyo, London, and New York, with specific opening times in South African Standard Time (SAST) that create unique trading opportunities.

- When is the best time to trade forex in South Africa?

- The London-New York overlap from 4:00 PM to 6:00 PM SAST generally offers the highest liquidity and volatility, making it an optimal window for many trading strategies.

- How does session overlap affect trading strategies?

- Session overlaps typically increase volatility and trading volume, creating a fertile ground for strategies like scalping and momentum trading that thrive on price movement.

- Does the trading platform provide alerts for session changes?

- Yes, our platform offers automated alerts via email, SMS, and push notifications to inform you of upcoming session openings, closures, and transitions, so you're always prepared.

- How is risk managed differently across sessions?

- Risk parameters like stop-loss ranges and position sizes should be adjusted based on session volatility. We recommend tighter stops during low-volatility Asian sessions and wider stops during the more volatile European and American sessions.