Key Takeaways

- FxPro offers advanced automated crypto trading bots tailored for South African beginners.

- Multiple bot types and risk management features help optimize trading strategies.

- Real-time analytics and platform compatibility ensure continuous performance monitoring.

Table of Contents

- Understanding Crypto Trading Bots at FxPro

- Setting Up Your First Crypto Trading Bot

- Types of Crypto Trading Bots Available

- Risk Management Features

- Performance Monitoring and Analytics

- Technical Requirements and Compatibility

- Getting Started with the Best Crypto Trading Bot for Beginners

- Ongoing Management and Optimization

Understanding Crypto Trading Bots at FxPro

Our company provides the Best Crypto Trading Bot for Beginners, offering sophisticated automated solutions specifically designed for South African traders. We offer algorithmic trading systems that execute trades based on predetermined parameters, eliminating emotional decision-making from your trading strategy. These automated tools operate 24/7, monitoring market conditions and executing trades when specific criteria are met.

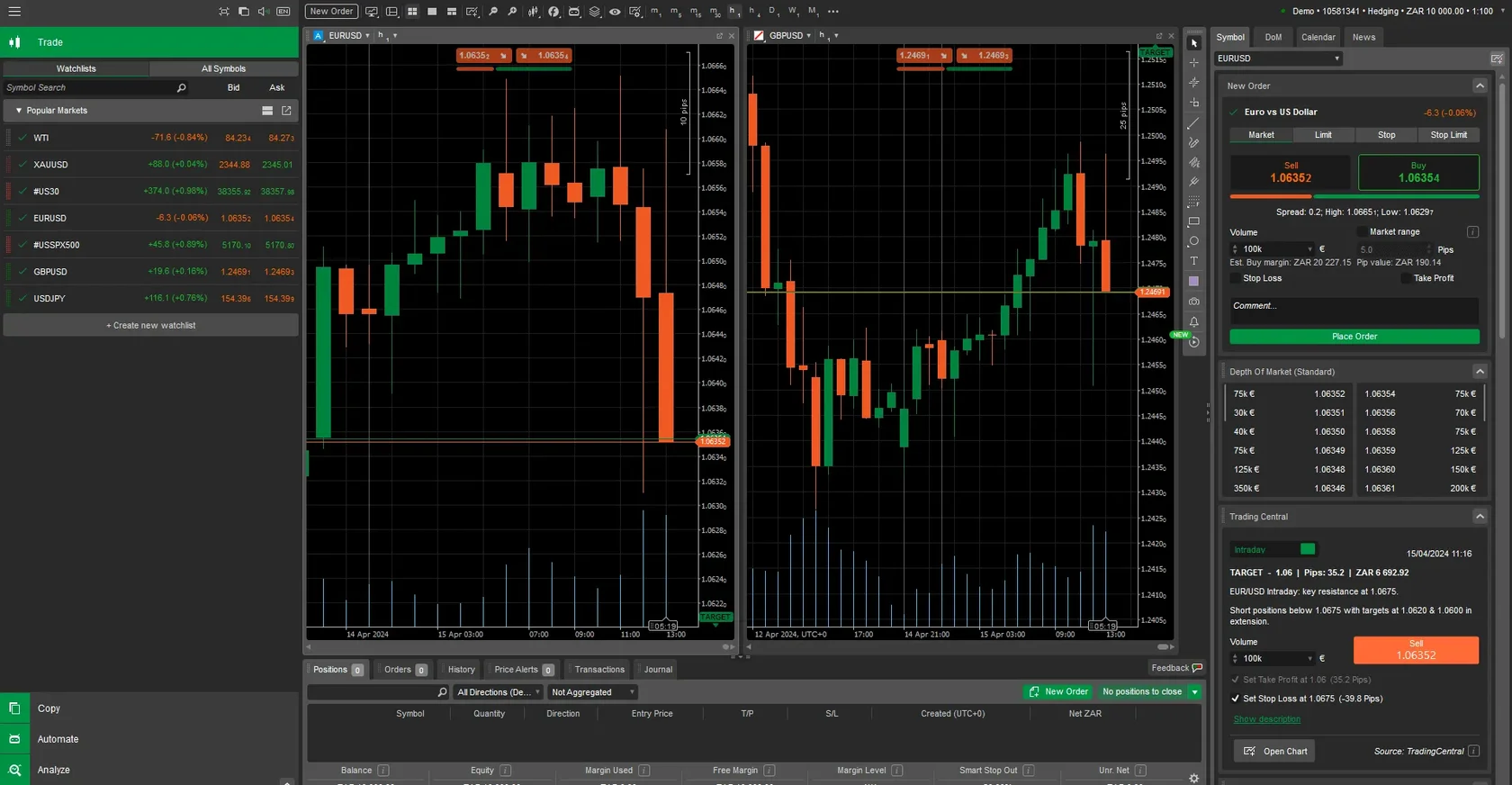

FxPro's crypto trading bots utilize advanced algorithms to analyze market data, identify trading opportunities, and execute positions automatically. Our platform supports multiple cryptocurrency pairs including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) against major fiat currencies. The system processes real-time market data through our MT4 and MT5 platforms, ensuring optimal execution speeds.

We integrate machine learning capabilities into our trading algorithms, allowing the system to adapt to changing market conditions. Our bots can process thousands of data points per second, identifying patterns that human traders might miss. The technology supports various trading strategies including scalping, swing trading, and trend following approaches.

| Feature | Specification | Benefit |

|---|---|---|

| Execution Speed | 0.03 seconds average | Faster market entry |

| Supported Pairs | 15+ crypto pairs | Diverse trading options |

| Operating Hours | 24/7 continuous | Never miss opportunities |

| Minimum Deposit | R1,000 | Accessible entry point |

Setting Up Your First Crypto Trading Bot

Account Configuration Requirements

Begin by accessing your FxPro account dashboard and navigating to the automated trading section. We require specific account settings to enable bot functionality, including verified identity documentation and a minimum account balance of R1,000. Our system automatically checks your account status and trading permissions before allowing bot activation.

Configure your risk management parameters through our dedicated interface. Set maximum daily loss limits, position sizing rules, and stop-loss levels according to your risk tolerance. We recommend starting with conservative settings: maximum 2% risk per trade and daily loss limits not exceeding 5% of your account balance.

Platform Integration Process

Download and install our MT4 or MT5 trading platform on your device. Connect your FxPro account credentials and ensure stable internet connectivity for uninterrupted bot operation. Our platform automatically synchronizes with our servers, providing real-time market data and execution capabilities.

Access the Expert Advisors (EA) section within your trading platform. Upload your selected crypto trading bot files and configure the input parameters. We provide detailed parameter explanations for each bot, including timeframe settings, risk levels, and currency pair selections.

Types of Crypto Trading Bots Available

Our platform offers several categories of automated trading systems, helping you find the best crypto trading bot for beginners tailored to your trading style. Trend-following bots identify and capitalize on sustained price movements in cryptocurrency markets. These systems use technical indicators like moving averages, MACD, and RSI to determine entry and exit points.

Scalping bots execute numerous small trades throughout the day, profiting from minor price fluctuations. We configure these systems to operate on shorter timeframes (1-minute to 15-minute charts) and target small profit margins per trade. The cumulative effect of multiple successful trades generates consistent returns.

Arbitrage bots exploit price differences between different cryptocurrency exchanges or trading pairs. Our system monitors multiple markets simultaneously, identifying opportunities where the same asset trades at different prices. These bots execute rapid buy and sell orders to capture the price differential.

- Grid trading bots that place multiple buy and sell orders at predetermined intervals

- Mean reversion systems that profit from price corrections after extreme movements

- Momentum-based algorithms that capitalize on strong directional price movements

- Market-making bots that provide liquidity while earning spreads

Risk Management Features

Automated Stop-Loss Implementation

We implement sophisticated risk management protocols within our crypto trading bots to protect your capital. Our systems automatically calculate optimal stop-loss levels based on market volatility and your specified risk parameters. The bots continuously monitor open positions and adjust stop-loss orders according to market conditions.

Dynamic position sizing ensures that each trade represents an appropriate percentage of your account balance. Our algorithms calculate the ideal trade size based on your risk tolerance, account equity, and the specific cryptocurrency pair's volatility. This prevents over-leveraging and protects against significant losses.

Portfolio Diversification Controls

Our platform enables simultaneous operation of multiple trading bots across different cryptocurrency pairs. We recommend diversifying your automated trading across at least three different crypto assets to reduce correlation risk. The system monitors overall portfolio exposure and prevents concentration in any single asset.

Maximum drawdown limits automatically pause bot operations when losses exceed predetermined thresholds. We set default limits at 15% of account equity, but you can adjust these parameters based on your risk appetite. The system sends immediate notifications when approaching these limits.

| Risk Parameter | Default Setting | Adjustable Range |

|---|---|---|

| Max Daily Loss | 5% of equity | 1% - 10% |

| Stop Loss | 2% per trade | 0.5% - 5% |

| Position Size | 1% risk per trade | 0.1% - 3% |

| Drawdown Limit | 15% of equity | 5% - 25% |

Performance Monitoring and Analytics

Real-Time Performance Tracking

Access comprehensive performance metrics through our dedicated analytics dashboard. We provide real-time updates on bot performance, including profit/loss ratios, win rates, and average trade duration. The system tracks individual bot performance and overall portfolio results.

Monitor key performance indicators (KPIs) such as Sharpe ratio, maximum drawdown, and return on investment. Our analytics engine calculates these metrics automatically, providing insights into your bot's effectiveness and risk-adjusted returns. Historical performance data spans up to 12 months for thorough analysis.

Customizable Reporting Features

Generate detailed trading reports for tax purposes and performance evaluation. We offer daily, weekly, and monthly reporting options with customizable parameters. Reports include transaction details, profit/loss calculations, and fee breakdowns in South African Rand.

Export trading data in multiple formats including CSV, PDF, and Excel for external analysis. Our reporting system automatically calculates tax implications based on South African Revenue Service (SARS) guidelines for cryptocurrency trading activities.

Technical Requirements and Compatibility

Our crypto trading bots operate on Windows, macOS, and Linux operating systems with minimum system requirements of 4GB RAM and stable internet connectivity. We recommend dedicated VPS hosting for optimal performance and 24/7 operation. The platform supports both desktop and mobile access for monitoring and management.

Ensure your trading environment meets our technical specifications for reliable bot operation. Minimum internet speed requirements include 10 Mbps download and 5 Mbps upload speeds. We provide technical support for setup and troubleshooting through our South African customer service team.

The system requires specific port configurations for communication with our trading servers. Enable ports 443 (HTTPS) and 993 (secure email) for proper functionality. Our technical documentation provides detailed network configuration instructions for optimal performance.

- Windows 10 or later with .NET Framework 4.7.2

- macOS 10.14 or later with updated security certificates

- Linux Ubuntu 18.04 LTS or equivalent distributions

- Minimum 50GB available storage space for data and logs

Getting Started with the Best Crypto Trading Bot for Beginners

Initial Setup Process

Create your FxPro account through our official website and complete the verification process. We require identity documentation, proof of address, and bank account verification for South African residents. The approval process typically takes 24-48 hours for complete account activation.

Fund your account using our supported payment methods including bank transfers, credit cards, and e-wallets. We accept deposits in South African Rand with automatic conversion to your preferred trading currency. Minimum deposit requirements vary by payment method, starting from R1,000.

Bot Selection and Configuration

Choose your first trading bot from our curated selection, designed to be the best crypto trading bot for beginners. We recommend starting with trend-following algorithms that operate on daily timeframes for reduced complexity. These bots require minimal configuration and provide educational value for understanding automated trading principles.

Configure basic parameters including trading pair selection, risk percentage, and operating hours. Start with conservative settings: 1% risk per trade, major cryptocurrency pairs (BTC/USD, ETH/USD), and standard market hours. Our system provides default configurations that work effectively for most beginners.

| Configuration Step | Recommended Setting | Purpose |

|---|---|---|

| Trading Pair | BTC/USD or ETH/USD | High liquidity markets |

| Risk Per Trade | 1% of account | Conservative approach |

| Timeframe | Daily (D1) | Reduced noise |

| Operating Hours | 24/7 | Continuous operation |

Ongoing Management and Optimization

Monitor your bot's performance weekly and adjust parameters based on market conditions and results. We provide performance benchmarks and optimization suggestions through our analytics platform. Regular review ensures your automated trading strategy remains aligned with your financial goals and that you are using the best crypto trading bot for beginners effectively.

Update your bot software regularly to benefit from our latest algorithm improvements and security enhancements. We release updates monthly, incorporating market feedback and technological advances. The update process is automated, requiring minimal user intervention while maintaining trading continuity.

Our customer support team provides ongoing assistance for South African traders, including strategy consultation and technical support. Contact our local support team during business hours (8:00 AM - 6:00 PM SAST) for immediate assistance with bot management and optimization questions.

FAQ

- What cryptocurrencies does FxPro's trading bot support?

- The bots support multiple pairs including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) against major fiat currencies.

- Is there a minimum deposit to start using the crypto trading bots?

- Yes, a minimum deposit of R1,000 is required to activate bot functionality and begin trading.

- Can I customize risk management settings on the bots?

- Absolutely. You can configure daily loss limits, stop-loss levels, and position sizing to match your risk tolerance.

- Which platforms are compatible with FxPro's crypto trading bots?

- The bots operate on MT4 and MT5 platforms, compatible with Windows, macOS, and Linux systems.

- How can I monitor the performance of my trading bots?

- Use FxPro's analytics dashboard for real-time tracking of profit/loss, win rates, KPIs, and historical performance.