Key Takeaways

- FxPro South Africa offers diversified long-term investment opportunities across multiple asset classes.

- Comprehensive tools and educational resources support strategic portfolio building and risk management.

- Account setup and verification are streamlined for South African residents with local regulatory compliance.

Table of Contents

- Understanding the Best Long Term Investments Through FxPro

- Setting Up Your FxPro Account for Investment Success

- Platform Navigation and Investment Tools

- Building Diversified Investment Portfolios

- Risk Management Strategies for Long-Term Success

- Tax Considerations for South African Investors

- Advanced Investment Strategies and Techniques

- Monitoring Performance and Making Adjustments

Understanding the Best Long Term Investments Through FxPro

Our company provides South African traders with comprehensive tools for building sustainable investment portfolios and finding the best long term investments. FxPro offers access to multiple asset classes including forex pairs, commodities, indices, and shares. We enable clients to implement diversified strategies across global markets from our regulated platform.

Long-term investing requires patience and strategic planning. Our platform supports position holding for extended periods without additional rollover fees on certain instruments. We provide educational resources specifically designed for South African market conditions and regulatory requirements.

The following investment approaches work effectively through our platform:

- Dollar-cost averaging across multiple currency pairs

- Commodity diversification including gold and oil futures

- Index fund replication through CFD positions

- Dividend-focused equity selections from international markets

- Emerging market exposure through specialized instruments

| Investment Type | Minimum Deposit (ZAR) | Typical Holding Period | Risk Level |

|---|---|---|---|

| Forex Majors | 1,000 | 6-12 months | Medium |

| Commodities | 2,500 | 12-24 months | High |

| Indices | 1,500 | 18-36 months | Medium |

| Individual Stocks | 3,000 | 24-60 months | High |

Setting Up Your FxPro Account for Investment Success

We streamline the registration process for South African residents. Our verification system accepts South African ID documents and proof of residence. The entire setup typically completes within 24 hours during business days.

Account Registration Requirements

Navigate to our official website and select the registration option. Choose South Africa as your country of residence. Enter your personal details including full name, email address, and mobile number. Create a secure password containing uppercase letters, numbers, and special characters.

Provide your residential address exactly as it appears on official documents. We require employment information and annual income details for regulatory compliance. Answer the trading experience questionnaire honestly to ensure appropriate risk warnings.

Document Verification Process

Upload a clear photo of your South African ID document or passport. Ensure all corners are visible and text remains readable. Submit proof of residence dated within the last three months. Acceptable documents include utility bills, bank statements, or municipal rates notices.

Our verification team reviews submissions within one business day. We may request additional documentation if initial uploads lack clarity. Phone verification occurs automatically through SMS codes sent to your registered mobile number.

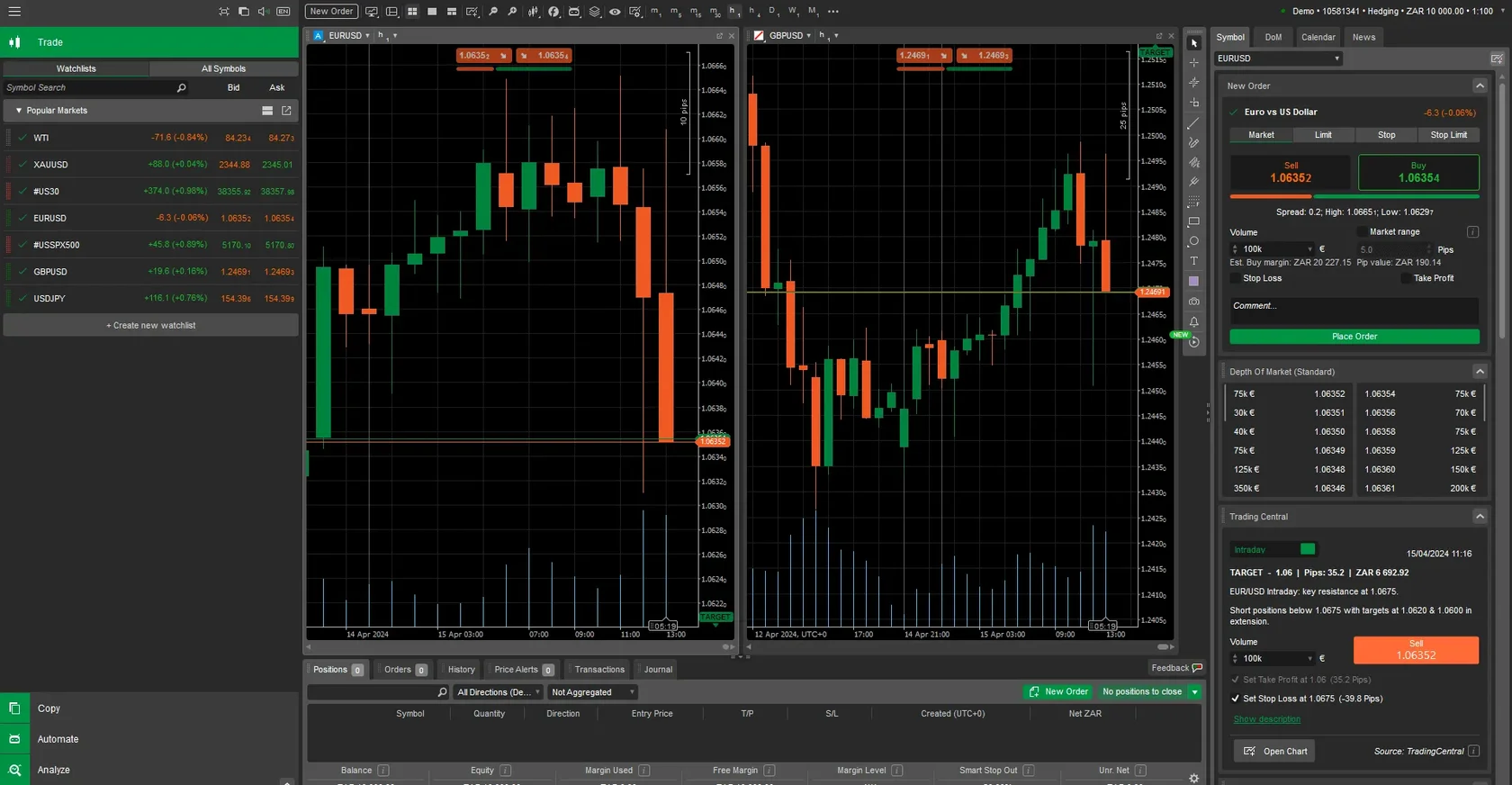

Platform Navigation and Investment Tools

Our trading platform offers multiple interfaces optimized for different investment styles. The web-based platform requires no downloads and works across all modern browsers. Mobile applications provide full functionality for iOS and Android devices.

Dashboard Configuration

Access your account dashboard immediately after login. Customize watchlists to monitor preferred instruments. Set up price alerts for significant market movements. Configure news feeds to receive updates relevant to your investment positions.

The portfolio overview displays current positions, unrealized profits, and account balance. We calculate performance metrics including return on investment and risk-adjusted returns. Historical performance data spans up to five years for comprehensive analysis.

Research and Analysis Features

Our platform integrates professional-grade charting tools. Access over 50 technical indicators including moving averages, RSI, and MACD. Apply multiple timeframes from one-minute to monthly charts. Save custom chart templates for consistent analysis approaches.

Fundamental analysis reports cover major economies and market sectors. We provide economic calendar integration showing upcoming events affecting your positions. Market sentiment indicators help gauge overall investor confidence levels.

Building Diversified Investment Portfolios

Portfolio diversification reduces risk while maintaining growth potential. Our platform supports simultaneous positions across multiple asset classes. We recommend allocating investments according to risk tolerance and investment timeline.

Conservative portfolios typically include 60% stable instruments and 40% growth-oriented assets. Moderate risk profiles balance equally between stable and volatile instruments. Aggressive strategies may allocate 70% to high-growth potential investments.

Currency diversification protects against rand volatility. We offer major currency pairs including USD/ZAR, EUR/ZAR, and GBP/ZAR. Commodity exposure through gold and platinum provides inflation hedging. International equity indices offer global market participation.

The following allocation strategy for the best long term investments suits most investors:

- 30% major currency pairs for stability

- 25% commodity positions for inflation protection

- 25% international equity indices for growth

- 20% emerging market instruments for higher returns

Risk Management Strategies for Long-Term Success

Effective risk management preserves capital during market downturns. Our platform provides multiple risk control tools including stop-loss orders and position sizing calculators. We recommend never risking more than 2% of account balance on single positions.

Stop-Loss and Take-Profit Orders

Set stop-loss orders at technically significant levels. We support trailing stops that adjust automatically as positions move favorably. Take-profit orders lock in gains at predetermined price levels. Modify orders as market conditions change.

Calculate position sizes based on account balance and risk tolerance. Our position sizing calculator determines appropriate lot sizes automatically. Consider correlation between different positions to avoid overexposure to similar market movements.

Portfolio Monitoring and Rebalancing

Review portfolio performance monthly rather than daily. Short-term volatility often reverses over longer periods. Rebalance positions quarterly to maintain target allocations. We provide portfolio analysis tools showing asset allocation drift.

Monitor correlation between different positions. High correlation reduces diversification benefits. Adjust position sizes when correlations increase during market stress periods. Our correlation matrix updates in real-time during trading hours.

| Risk Management Tool | Purpose | Recommended Usage |

|---|---|---|

| Stop-Loss Orders | Limit downside risk | Set 2-3% below entry |

| Position Sizing | Control exposure | Max 2% risk per trade |

| Correlation Analysis | Avoid overexposure | Check weekly |

| Portfolio Rebalancing | Maintain allocation | Quarterly review |

Tax Considerations for South African Investors

South African tax residents must declare foreign investment gains. Our platform provides detailed transaction histories for tax reporting purposes. We recommend consulting qualified tax professionals for specific advice regarding your situation.

Capital gains tax applies to profitable positions held longer than three years. The annual exclusion amount changes yearly according to SARS regulations. Keep detailed records of all transactions including entry dates, exit dates, and associated costs.

Foreign exchange gains may qualify for different tax treatment. Currency hedging strategies can minimize tax implications. We provide monthly statements showing all trading activity and associated costs.

Record Keeping Requirements

Download monthly statements directly from your account dashboard. Save transaction confirmations for all opening and closing trades. Record any additional costs including overnight financing charges. Maintain organized files for easy tax preparation.

Our reporting tools calculate realized and unrealized gains automatically. Export data in multiple formats compatible with popular accounting software. We retain transaction records for seven years as required by financial regulations.

Advanced Investment Strategies and Techniques

Experienced investors can implement sophisticated strategies through our platform. We support hedging techniques, carry trades, and arbitrage opportunities. Advanced order types enable complex position management without constant monitoring.

Carry Trade Strategies

Carry trades involve borrowing low-yielding currencies to purchase higher-yielding alternatives. Our platform displays overnight financing rates for all currency pairs. Calculate potential returns including both price appreciation and interest differentials.

Popular carry trade pairs include AUD/JPY, NZD/JPY, and USD/TRY. Monitor central bank policies affecting interest rate differentials. Political stability impacts carry trade profitability significantly.

Hedging Techniques

Hedge existing positions using correlated instruments. Currency hedging protects international equity positions from exchange rate fluctuations. We offer currency forwards and options for sophisticated hedging strategies.

Commodity hedging works effectively for inflation protection. Gold positions often move inversely to equity markets during stress periods. Oil positions provide energy sector exposure without individual company risks.

The following hedging combinations work effectively:

- Long EUR/USD with short GBP/USD for European exposure

- Gold positions offsetting equity market volatility

- Commodity currencies paired with actual commodity positions

- Bond proxies through government bond CFDs

Monitoring Performance and Making Adjustments

Regular performance evaluation ensures investment strategies remain effective. Our platform calculates multiple performance metrics including Sharpe ratios and maximum drawdown figures. Compare your results against relevant benchmarks.

Monthly performance reviews identify successful strategies and problematic positions. We provide performance attribution analysis showing which positions contributed most to overall returns. Adjust strategies based on changing market conditions.

| Performance Metric | Calculation Method | Target Range |

|---|---|---|

| Annual Return | (Ending Value - Starting Value) / Starting Value | 8-15% |

| Sharpe Ratio | (Return - Risk-free Rate) / Standard Deviation | Above 1.0 |

| Maximum Drawdown | Largest Peak-to-Trough Decline | Below 20% |

| Win Rate | Profitable Trades / Total Trades | Above 55% |

Set realistic performance expectations based on market conditions. Bull markets enable higher returns while bear markets require capital preservation focus. Our historical data helps establish appropriate benchmarks for different market environments.

Document lessons learned from both successful and unsuccessful positions. We provide trade journals within the platform for recording decision-making processes. Review these notes regularly to improve future investment decisions.

Achieving success with the best long term investments through FxPro requires patience, discipline, and continuous learning. Our platform provides all necessary tools for building wealth over extended periods. We support South African investors with localized services and regulatory compliance.

FAQ

- What asset classes can I invest in with FxPro South Africa?

- You can invest in forex pairs, commodities, indices, and shares using FxPro’s platform.

- How long does the account verification process take?

- Verification typically completes within 24 hours on business days after submitting required documents.

- Does FxPro charge rollover fees for long-term positions?

- Certain instruments allow position holding without additional rollover fees for extended periods.

- Can I access the trading platform on mobile devices?

- Yes, FxPro offers fully functional mobile applications for both iOS and Android devices.

- What risk management tools are available?

- The platform includes stop-loss orders, take-profit orders, position sizing calculators, and correlation analysis.