Reading time estimate

Key Takeaways

- Utilize advanced FxPro trading tools tailored for South African traders.

- Apply proven technical analysis and risk management strategies.

- Leverage platform features for automated trading and performance monitoring.

Table of Contents

- Understanding FxPro Trading Platform Features

- Technical Analysis Strategies for Consistent Profits

- Risk Management Protocols

- Market Analysis and Entry Timing

- Advanced Trading Strategies Implementation

- Platform Tools and Features Utilization

- Performance Monitoring and Optimization

- Common Trading Mistakes and Prevention

Understanding FxPro Trading Platform Features

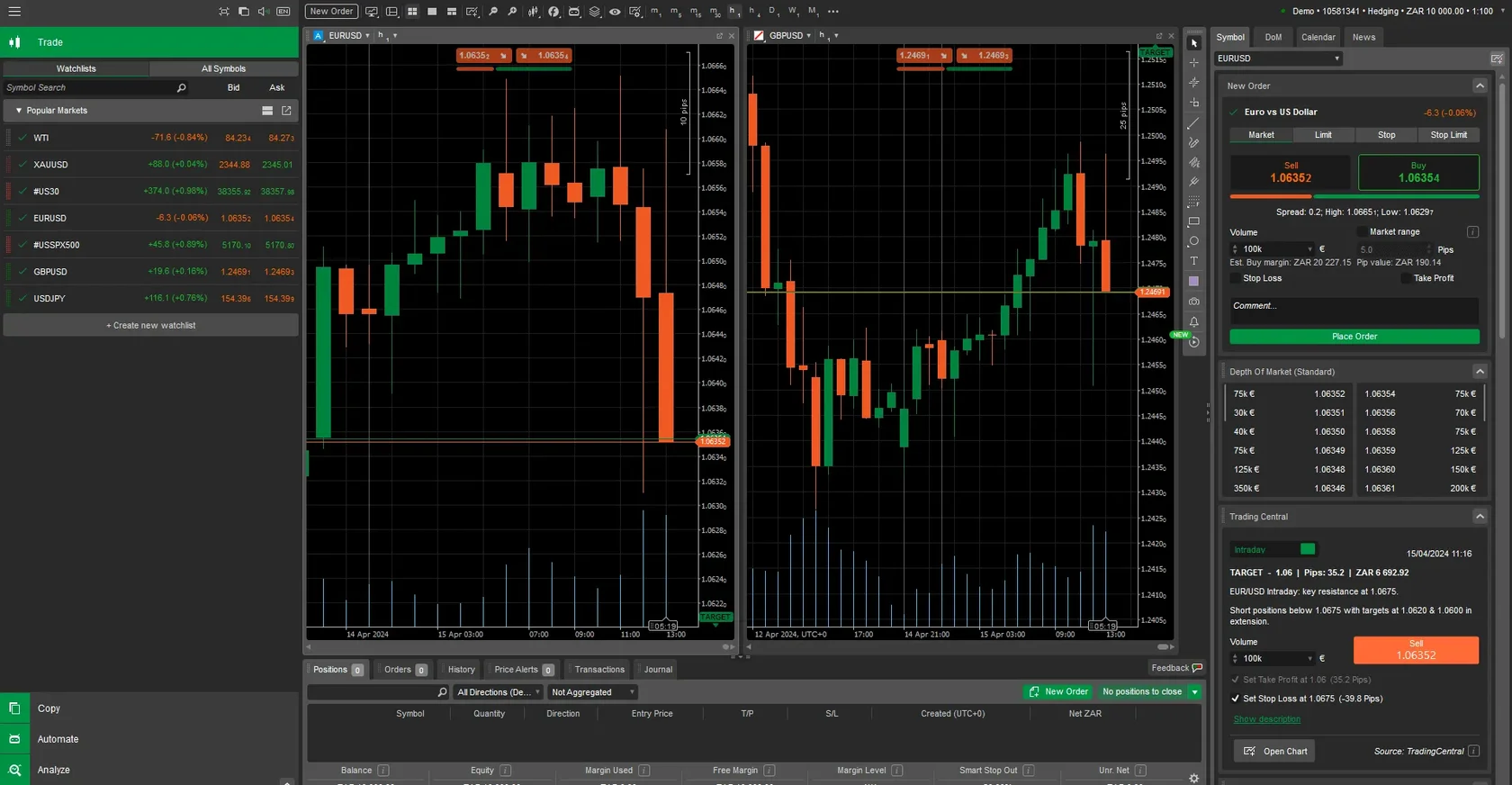

Our company provides South African traders with comprehensive access to advanced trading tools through the FxPro platform. The MetaTrader 4 and MetaTrader 5 platforms offer real-time market data, automated trading capabilities, and professional charting tools. We support over 70 currency pairs, including major pairs like USD/ZAR, EUR/ZAR, and GBP/ZAR specifically relevant to South African markets.

The platform operates with spreads starting from 0.0 pips on our Raw account type. Our execution speed averages 13 milliseconds, ensuring minimal slippage during volatile market conditions. We provide leverage up to 1:30 for retail clients in South Africa, complying with local FSCA regulations.

Account Types and Specifications

We offer four distinct account types tailored for different trading approaches. The Instant account requires no minimum deposit and provides fixed spreads from 1.8 pips. Our Raw account charges commission of $3.50 per lot but offers spreads from 0.0 pips. The cTrader account supports ECN execution with market depth visibility.

Professional traders can access our Pro account with enhanced leverage options. Each account type supports ZAR deposits through local banking methods. We process withdrawals to South African bank accounts within 1-3 business days.

| Account Type | Minimum Deposit | Spread | Commission | Leverage |

|---|---|---|---|---|

| Instant | R0 | 1.8 pips | None | 1:30 |

| Raw | R1,000 | 0.0 pips | $3.50/lot | 1:30 |

| cTrader | R1,000 | 0.1 pips | $4.50/lot | 1:30 |

| Pro | R25,000 | Variable | Negotiable | 1:500 |

Technical Analysis Strategies for Consistent Profits

Moving Average Convergence Strategies

We recommend implementing dual moving average systems for trend identification. The 20-period exponential moving average (EMA) combined with the 50-period simple moving average (SMA) creates reliable entry signals. When the 20 EMA crosses above the 50 SMA, this indicates potential upward momentum.

Our platform provides automated alert systems for moving average crossovers. You can configure email notifications, SMS alerts, and push notifications through the FxPro mobile application. The system monitors up to 100 currency pairs simultaneously for crossover signals.

Configure stop-loss orders at 1.5 times the average true range (ATR) below entry points. Set take-profit targets at 3 times the ATR above entry levels to maintain a 1:2 risk-reward ratio. This approach generates positive expectancy over extended trading periods.

Support and Resistance Level Trading

Identify key support and resistance levels using our advanced charting tools. The platform automatically calculates pivot points, Fibonacci retracements, and psychological price levels. We provide historical data spanning 10 years for comprehensive level analysis.

Mark significant price levels where previous reversals occurred. These levels often act as future support or resistance zones. Our system highlights these levels with automatic trendline drawing and price alert functionality.

Execute trades when price approaches these levels with confirmation signals. Use candlestick patterns like doji, hammer, or engulfing patterns for entry confirmation. Position sizing should not exceed 2% of account equity per trade.

Risk Management Protocols

Effective risk management forms the foundation of profitable trading strategies. We implement position sizing calculators directly within our trading platform. The system automatically calculates optimal lot sizes based on account balance, risk percentage, and stop-loss distance.

Never risk more than 1-2% of total account equity on individual trades. Our platform enforces maximum risk limits through automated position sizing controls. You can set daily, weekly, and monthly loss limits to prevent emotional trading decisions.

Stop-Loss and Take-Profit Implementation

Configure stop-loss orders immediately upon trade entry. Our platform supports guaranteed stop-loss orders for major currency pairs during market hours. These orders execute at exact specified prices regardless of market gaps or slippage.

Set take-profit levels at predetermined price targets based on technical analysis. Use trailing stops to lock in profits as trades move favorably. Our trailing stop feature adjusts automatically as price moves in your direction.

The platform supports partial profit-taking strategies. Close 50% of position size at first target level, move stop-loss to breakeven, and let remaining position run to second target. This approach maximizes profit potential while protecting capital.

Market Analysis and Entry Timing

Economic Calendar Integration

Our platform integrates real-time economic calendar data for South African and global markets. Monitor key events like SARB interest rate decisions, GDP releases, and inflation data. These events create significant volatility in ZAR currency pairs.

High-impact news events often generate 50-100 pip movements within minutes. Avoid trading 30 minutes before and after major announcements unless using specific news trading strategies. Our calendar highlights impact levels and expected volatility ranges.

Set up custom alerts for events affecting your preferred currency pairs. The system sends notifications 15 minutes before scheduled releases. This preparation time allows position adjustment or trade closure before volatile periods.

Multi-Timeframe Analysis Approach

Analyze market trends across multiple timeframes for optimal entry timing. Use daily charts for overall trend direction, 4-hour charts for swing trading setups, and 1-hour charts for precise entry points. This approach improves trade accuracy significantly.

Our platform supports synchronized chart analysis across up to 16 different timeframes simultaneously. Save custom chart templates with preferred indicators and timeframe combinations. Quick template switching enables rapid market analysis.

Enter trades only when all timeframes align in the same direction. Daily uptrend, 4-hour pullback completion, and 1-hour bullish reversal create high-probability setups. This confluence approach reduces false signals and improves win rates.

Advanced Trading Strategies Implementation

Scalping Techniques for Short-Term Profits

Scalping strategies target small price movements over short timeframes. Our Raw account type provides optimal conditions with spreads from 0.0 pips and commission-based pricing. Execute 10-50 trades daily targeting 3-10 pip profits per trade.

Use 1-minute and 5-minute charts for scalping analysis. Monitor order flow through Level II market data available on our cTrader platform. Look for imbalances between buy and sell orders to predict short-term price direction.

Implement strict time-based exits for scalping trades. Close positions within 5-15 minutes regardless of profit or loss status. This approach prevents small losses from becoming large losses during unexpected market moves.

| Strategy Type | Timeframe | Target Pips | Risk-Reward | Win Rate Required |

|---|---|---|---|---|

| Scalping | 1-5 min | 3-10 | 1:1 | 60%+ |

| Day Trading | 15-60 min | 15-50 | 1:2 | 40%+ |

| Swing Trading | 4H-Daily | 50-200 | 1:3 | 35%+ |

| Position Trading | Weekly | 200-500 | 1:4 | 30%+ |

Swing Trading for Medium-Term Gains

Swing trading captures price movements over 2-10 days. This approach suits traders with limited time for constant market monitoring. Our platform supports automated trade management through expert advisors and trading robots.

Identify swing trading opportunities using daily chart analysis. Look for trend continuation patterns like flags, pennants, and triangles. These patterns often precede significant price movements in the direction of the prevailing trend.

Hold positions for 3-7 days on average. Use wider stop-losses to accommodate normal market fluctuations. Set initial stop-loss at 50-100 pips depending on currency pair volatility and recent average true range values.

Platform Tools and Features Utilization

Our trading platform provides comprehensive tools for strategy implementation and trade management. The one-click trading feature enables rapid order execution during fast-moving markets. Customize hotkeys for instant buy, sell, and position closure commands.

Access over 80 technical indicators including custom indicators developed specifically for our platform. Create personalized indicator combinations and save them as templates. The system supports unlimited chart windows for simultaneous market monitoring.

Automated Trading Systems Integration

Deploy expert advisors (EAs) for automated strategy execution. Our platform supports MQL4 and MQL5 programming languages for custom EA development. We provide a marketplace with over 2,000 tested trading robots and indicators.

Backtest strategies using historical data spanning 15 years. The strategy tester includes tick-by-tick simulation for maximum accuracy. Optimize EA parameters using genetic algorithms to find optimal settings for current market conditions.

Forward test strategies on demo accounts before live implementation. Our demo environment replicates live market conditions exactly. Test automated systems for minimum 30 days before deploying real capital.

Mobile Trading Capabilities

Access full trading functionality through our mobile applications for iOS and Android devices. The mobile platform supports all order types, technical analysis tools, and account management features. Execute trades, modify positions, and monitor markets from anywhere in South Africa.

Enable push notifications for price alerts, margin calls, and order executions. The mobile app synchronizes with desktop platforms in real-time. Charts, watchlists, and trading templates remain consistent across all devices.

Use mobile-specific features like one-tap trading and gesture-based chart navigation. The app supports fingerprint and face recognition for secure account access. Offline chart viewing allows analysis without internet connectivity.

Performance Monitoring and Optimization

Track trading performance using our comprehensive analytics dashboard. Monitor key metrics including win rate, average profit per trade, maximum drawdown, and Sharpe ratio. The system calculates these statistics automatically for any selected time period.

Generate detailed trading reports for tax purposes and performance analysis. Export data in CSV, PDF, and Excel formats. Reports include all trade details, commission costs, and profit/loss calculations in ZAR currency.

Trade Journal and Analysis Tools

Maintain detailed trade records using our integrated journal system. Record entry reasons, market conditions, and emotional state for each trade. This data helps identify patterns in profitable and losing trades.

Analyze trading patterns using statistical tools built into the platform. Identify optimal trading times, most profitable currency pairs, and successful strategy variations. Use this analysis to refine and improve trading approaches continuously.

Set performance benchmarks and track progress toward trading goals. The system provides visual charts showing account growth, monthly returns, and consistency metrics. Compare performance against market indices and other traders anonymously.

| Performance Metric | Target Range | Calculation Method | Review Frequency |

|---|---|---|---|

| Win Rate | 45-65% | Winning trades / Total trades | Weekly |

| Risk-Reward Ratio | 1:2 minimum | Average win / Average loss | Monthly |

| Maximum Drawdown | <15% | Peak to trough decline | Continuous |

| Monthly Return | 3-8% | Monthly profit / Starting capital | Monthly |

Common Trading Mistakes and Prevention

Avoid overtrading by setting daily and weekly trade limits. Our platform includes position limit controls to prevent excessive market exposure. Limit concurrent positions to 3-5 trades maximum to maintain proper risk management.

Emotional trading leads to significant losses. Use predetermined entry and exit rules without deviation. Our platform supports automated trade execution to remove emotional decision-making from the trading process.

Never add to losing positions without proper analysis. This practice, known as averaging down, can lead to catastrophic losses. Instead, accept small losses and wait for new trading opportunities with fresh analysis.

Prevent margin calls by monitoring account equity continuously. Our platform provides real-time margin level calculations and automatic warnings at 100% margin level. Close positions or add funds before reaching critical margin levels.

How to Win Every Trade in FxPro requires disciplined application of proven strategies, comprehensive risk management, and continuous performance monitoring. Our platform provides all necessary tools for implementing these approaches successfully in South African markets. Focus on consistency rather than seeking perfect trades, as sustainable profitability comes from systematic execution of well-tested strategies over extended periods.

FAQ

- What leverage is available for South African retail clients on FxPro?

- Leverage of up to 1:30 is available for retail clients in South Africa, complying with FSCA regulations.

- How fast is the execution speed on the FxPro platform?

- Execution speed averages 13 milliseconds, ensuring minimal slippage during volatile market conditions.

- What risk percentage per trade does FxPro recommend?

- It is recommended to never risk more than 1-2% of total account equity on individual trades.

- Can I use automated trading strategies on FxPro?

- Yes, the platform supports expert advisors (EAs) with MQL4 and MQL5 support and offers a marketplace with over 2,000 trading robots and indicators.

- How long does withdrawal processing take for South African bank accounts?

- Withdrawals are processed within 1-3 business days to South African bank accounts.