Key Takeaways

- Master Rollovers: Understand how to extend positions overnight and manage swap rates, which can be either a cost or a credit to your account.

- Full Platform Control: FxPro offers both automated and manual rollover management, giving you the flexibility to match your trading strategy.

- Informed Trading: Benefit from transparent, real-time rollover information and configurable settings to optimize your trading outcomes.

Table of Contents

- Understanding Trade Rollover Fundamentals

- Accessing the FxPro Trading Platform

- How to Rollover a Trade on FxPro: Manual Execution Steps

- Configuring Automatic Rollovers

- Understanding Swap Rates and Rollover Costs

- Weekend and Holiday Rollover Procedures

- Advanced Rollover Strategies for a Professional Edge

- FAQ & Troubleshooting Common Rollover Issues

Understanding Trade Rollover Fundamentals

Trade rollover, also known as a swap, is a critical mechanism in forex trading that allows you to hold positions open overnight. On the FxPro platform, this process is mostly automated for your convenience, but a deep understanding empowers you to make superior trading decisions. A rollover occurs when you maintain a position beyond the market's closing time, typically 22:00 GMT.

Essentially, the process involves closing your open position at the end of the day and instantly opening an identical one for the next trading day. This action incurs a cost or a credit, known as the swap rate. This rate is determined by the interest rate differential between the two currencies in your traded pair. Knowing how to rollover a trade on FxPro effectively means managing these costs and potential earnings.

If you are long a currency with a higher interest rate against one with a lower rate, you will receive a positive swap (a credit). Conversely, holding a lower-yielding currency against a higher-yielding one results in a negative swap (a debit). FxPro ensures this process is seamless and transparent, with all calculations displayed in real-time directly on the platform.

| Rollover Component | Description | Impact on Account |

|---|---|---|

| Swap Rate | Interest rate differential between two currencies | Credit or Debit |

| Rollover Time | Typically 22:00 GMT (standard time) | Automatic Execution |

| Position Extension | Moves the position to the next trading day | Continuous Market Exposure |

| Cost Calculation | Displayed in real-time on the platform | Transparent Pricing |

Accessing the FxPro Trading Platform

FxPro provides traders with robust and flexible access to their accounts via a web-based interface, dedicated desktop applications, and powerful mobile apps. Crucially, rollover functionality remains consistent across all platforms, ensuring you can manage your trades seamlessly from any device.

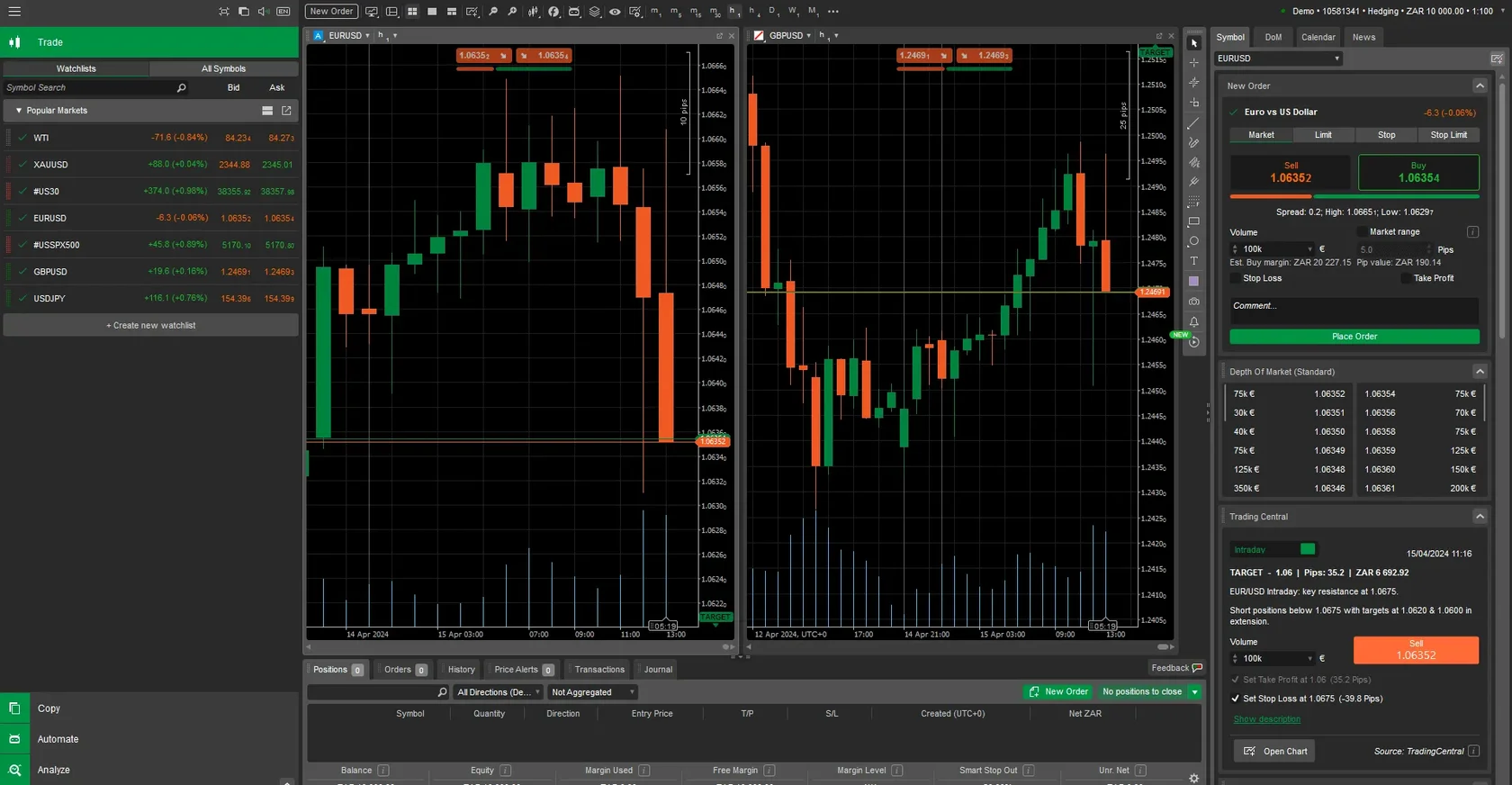

To begin, log into your FxPro account with your registered credentials. Once inside, navigate to the main trading terminal where your open positions are clearly displayed. The platform provides comprehensive rollover information for each position, including estimated swap charges and precise rollover timing.

Platform Login Procedures

Access your FxPro account by visiting the official website and selecting "Login". Once you enter your credentials, you may be asked for additional verification for enhanced security. From there, you can choose your preferred trading platform: MetaTrader 4, MetaTrader 5, or cTrader, all of which fully support advanced rollover management.

Navigation to Position Management

Within your chosen platform, the terminal window is your command center. It displays all open trades with vital data like position size, real-time profit/loss, and detailed rollover information. By clicking on any open position, you can drill down into specific swap data, helping you make fully informed decisions about your ongoing trades.

How to Rollover a Trade on FxPro: Manual Execution Steps

While FxPro's automated system is highly efficient, strategic traders may opt for manual rollover execution to gain greater control over timing and costs. This hands-on approach is particularly beneficial for those implementing carry trade strategies or managing substantial positions, as it allows for the precise optimization of swap charges.

To execute a manual rollover, you must close your existing position just before the automatic rollover time and immediately reopen an identical position. This requires precision and a clear understanding of market conditions. FxPro's platform provides the necessary tools to facilitate this process smoothly.

Position Closure Procedures

In the terminal window, right-click on your open position and select "Close Order" from the context menu. The platform will display the current market price and the exact closing value. Confirm the closure, and the system will execute it instantly at the prevailing market rate.

Immediate Position Reopening

After the position is closed, you must act swiftly to reopen it with the exact same parameters (currency pair, position size, and direction). To minimize delay and potential slippage, you can use order templates. Ensure you have sufficient margin available before submitting the new order to maintain your market exposure seamlessly.

Configuring Automatic Rollovers

For maximum convenience, the FxPro platform offers comprehensive automatic rollover settings that eliminate the need for manual intervention. These configurations ensure your positions continue seamlessly while optimizing swap charges based on your predefined preferences. This "set-and-forget" feature allows you to focus on your strategy, not on administrative tasks.

You can access these settings through the platform's settings menu. Here, you can enable or disable automatic rollovers, set limits for swap charges, and configure notifications for rollover events. This intelligent system monitors all open positions and executes rollovers at the optimal time based on market conditions and your settings.

Key configuration options include:

- Enabling/disabling automatic rollover for all positions.

- Setting swap charge thresholds to trigger automatic closure.

- Customizing notifications for rollover events via Email, SMS, or in-platform alerts.

- Defining currency-pair-specific rollover preferences.

| Configuration Setting | Options Available | Recommended Setting |

|---|---|---|

| Auto Rollover | Enabled/Disabled | Enabled (for convenience) |

| Swap Limit | Custom threshold ($) | Based on risk tolerance |

| Notifications | Email/SMS/Platform | All methods |

| Weekend Handling | Close/Rollover | Based on strategy |

Understanding Swap Rates and Rollover Costs

A thorough understanding of swap rates is the foundation of effective rollover management. These rates, representing the interest rate differential between currency pairs, directly impact your bottom line. They can be a cost or a source of income. These rates are dynamic and fluctuate based on central bank policies and market liquidity.

FxPro provides real-time swap rates for all currency pairs in the "Market Watch" window, showing both long (buy) and short (sell) swap values. A positive value indicates a potential earning, while a negative value represents a cost for holding a position overnight. A key part of learning how to rollover a trade on FxPro is turning this knowledge into profitable opportunities.

Calculating and Optimizing Swaps

Use FxPro's built-in calculator to estimate rollover costs accurately. By entering your position details, you can evaluate if holding a trade overnight aligns with your profit targets. For those looking to optimize, focus on identifying positive swap opportunities. Carry trade strategies, which involve holding high-yielding currencies against low-yielding ones, are designed specifically to capitalize on these favorable interest rate differentials.

Weekend and Holiday Rollover Procedures

Holding positions over weekends and holidays requires special attention. Due to market closures, rollovers on Wednesdays typically incur a triple swap charge to account for Saturday and Sunday. The FxPro platform handles these complex calculations automatically, but awareness is key to managing your costs effectively.

Holiday rollovers depend on the specific currency pairs and the respective international banking holidays. FxPro provides advance notifications via email, SMS, and platform messages, ensuring you are never caught by surprise. Plan your trades around these periods to avoid unexpected charges, and consider closing positions before extended market closures if swaps could significantly impact your profitability.

| Period Type | Swap Multiplier | Advance Notice | Recommended Action |

|---|---|---|---|

| Regular Weekend | 3x on Wednesday | 24 hours | Monitor positions |

| Bank Holiday | Variable | 48 hours | Consider closure |

| Extended Holiday | Up to 5x | 72 hours | Close or hedge |

| Year-end Period | Variable | 1 week | Review strategy |

Advanced Rollover Strategies for a Professional Edge

Professional traders leverage sophisticated rollover strategies to gain a competitive edge. These approaches go beyond simple position holding and combine deep analysis with strategic execution. By mastering these techniques on the FxPro platform, you can significantly enhance your trading outcomes.

Carry Trade Implementation

The most popular advanced strategy is the carry trade. This involves holding a position in a currency pair with a significant positive swap rate for an extended period, earning interest daily. Success demands careful analysis of interest rate trends and central bank policies. FxPro's research tools provide the necessary data to support these decisions.

Rollover Hedging and Arbitrage

Advanced traders may also use hedging to protect positions from adverse swap charges while maintaining market exposure. Furthermore, arbitrage opportunities can arise from comparing swap rates across different brokers. FxPro's competitive swap rates often provide a distinct advantage that savvy traders can incorporate into their strategy.

FAQ & Troubleshooting Common Rollover Issues

Even on a robust platform like FxPro, you might occasionally have questions. Here’s how to troubleshoot common rollover issues swiftly. Most issues relate to timing, calculations, or connectivity during the rollover period. FxPro's 24/7 support team is always available to provide assistance.

- Connection Interruptions

- The platform features automatic reconnection and position recovery systems. However, having a backup internet connection or the mobile app ready is a good practice.

- Swap Calculation Discrepancies

- These are rare but can occur due to rapid market changes. If you notice any unusual charges, contact the support team immediately. They maintain detailed logs to investigate and resolve discrepancies quickly.

- Platform Synchronization

- Ensure your platform's time is synchronized with FxPro's servers. Regularly clearing your cache and updating the platform can prevent most sync-related issues.

- What are the key resolution procedures?

-

- Immediate platform restart and reconnection

- Position verification through multiple platform interfaces

- Support ticket submission with detailed issue description

- Account statement review for charge verification

- Backup platform access through mobile applications

For any unresolved issues, contact the support team via phone, email, or live chat with your account number and trade details for expedited resolution.