Key Takeaways

- Implement the Takashi Kotegawa Strategy using FxPro’s advanced tools tailored for South African markets.

- Set up and configure your FxPro account with streamlined verification and multiple account types.

- Utilize platform features including advanced charting, risk management, and performance monitoring to perfect your Takashi Kotegawa Strategy.

Table of Contents

- Understanding the Takashi Kotegawa Strategy Framework

- Setting Up Your FxPro Account for Strategy Implementation

- Platform Tools for Takashi Kotegawa Strategy Execution

- Risk Management Implementation

- Market Analysis Tools and Indicators

- Execution Strategies and Order Types for the Takashi Kotegawa Strategy

- Performance Monitoring and Analysis

- Advanced Features and Customization

Understanding the Takashi Kotegawa Strategy Framework

The Takashi Kotegawa Strategy represents one of the most successful day trading methodologies developed by Japan's legendary trader who transformed ¥1.6 million into ¥18 billion. Our FxPro platform provides the essential tools to implement this strategy effectively in South African markets. This approach focuses on identifying momentum breakouts, managing risk through precise position sizing, and capitalizing on intraday price movements.

We offer specialized charting tools that support the core principles of the Takashi Kotegawa Strategy. Our platform includes real-time market data, advanced technical indicators, and customizable alerts that align with this methodology. South African traders can access these features through our MetaTrader 4, MetaTrader 5, and cTrader platforms.

The strategy emphasizes quick decision-making and disciplined execution. Our trading infrastructure supports rapid order processing with execution speeds averaging 0.03 seconds. This performance level ensures traders can capitalize on the brief market opportunities that define the Takashi Kotegawa Strategy.

| Platform Feature | Takashi Kotegawa Strategy Application | Execution Speed |

|---|---|---|

| Real-time Charts | Momentum identification | Instant updates |

| Order Management | Position sizing control | 0.03 seconds |

| Risk Tools | Stop-loss automation | Real-time |

| Alert System | Breakout notifications | Immediate |

Setting Up Your FxPro Account for Strategy Implementation

Creating your FxPro account requires completing our streamlined registration process designed for South African traders. Navigate to our official website and click the "Register" button prominently displayed on the homepage. Select South Africa as your country of residence and provide your email address along with a secure password.

Complete the personal information section with your full name, date of birth, and contact details. Our system validates this information against South African regulatory requirements. Confirm your phone number through our SMS verification system to enhance account security.

Document Verification Process

Upload your South African ID, passport, or driver's license for identity verification. Provide proof of residence using a recent utility bill dated within the last six months. Complete the liveness check using your smartphone camera for additional security verification.

Our verification team reviews documents within 24 hours during business days. Once approved, you can access all trading features necessary for implementing the Takashi Kotegawa Strategy. The verification process ensures compliance with FSCA regulations protecting South African traders.

Account Configuration Options

Select your preferred trading account type from our available options:

- Standard Account: Suitable for beginners with competitive spreads

- Raw+ Account: Advanced traders benefit from institutional-grade execution

- Demo Account: Practice the Takashi Kotegawa Strategy risk-free

Choose your base currency (ZAR, USD, EUR) and set leverage preferences according to your risk tolerance. Configure execution methods between netting and hedging based on your trading style requirements.

Platform Tools for Takashi Kotegawa Strategy Execution

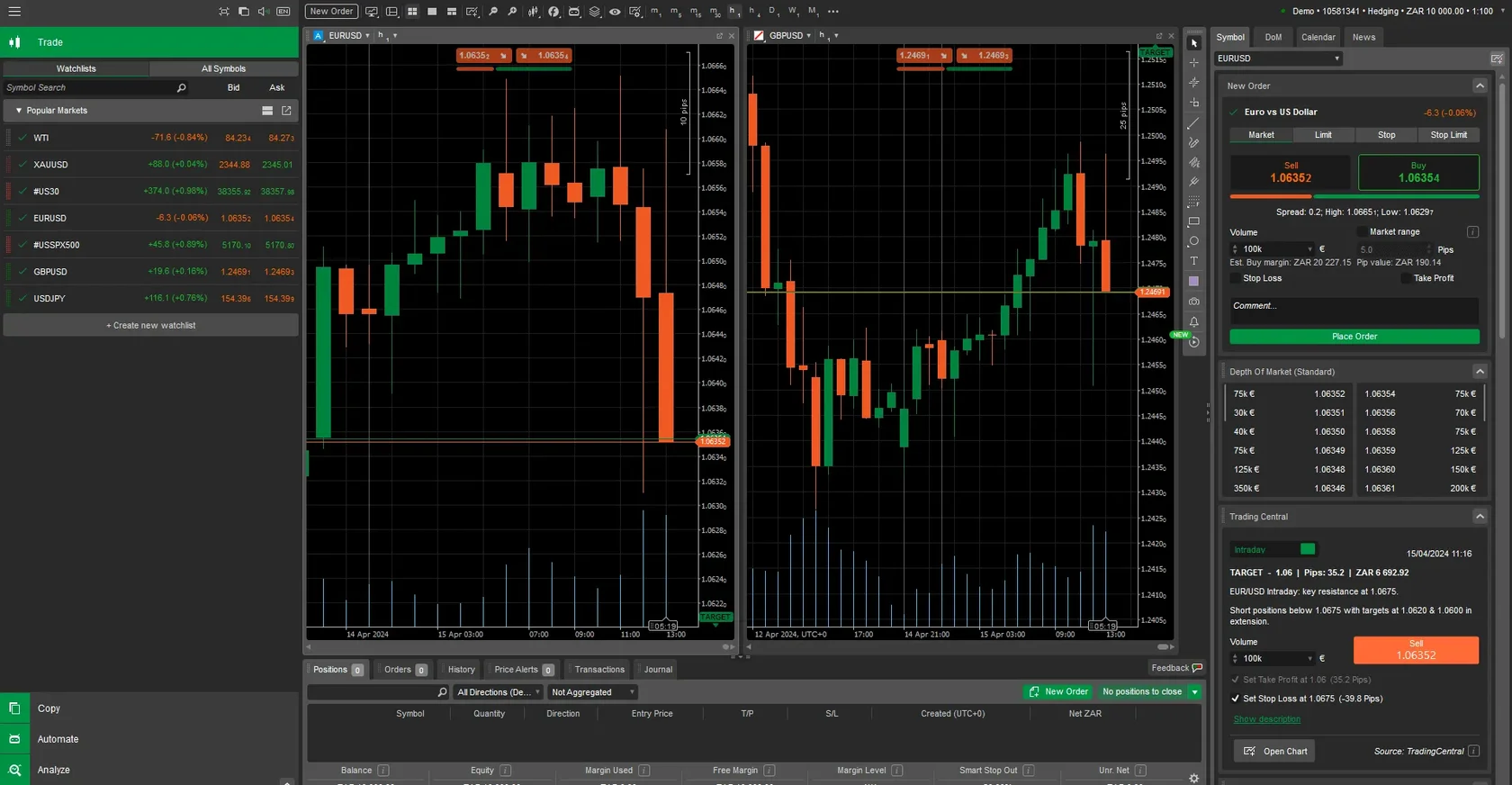

Our MetaTrader 5 platform provides comprehensive tools specifically suited for the Takashi Kotegawa Strategy implementation. Access advanced charting capabilities with over 80 technical indicators and 46 analytical objects. The platform supports multiple timeframes essential for identifying momentum breakouts.

Configure custom indicators that align with the Takashi Kotegawa Strategy methodology. Our platform includes moving averages, RSI, MACD, and volume indicators crucial for this approach. Set up automated alerts for specific price levels and technical pattern formations.

The Expert Advisor functionality allows automation of certain strategy components. Program specific entry and exit rules based on the Takashi Kotegawa Strategy principles. Our VPS hosting ensures continuous strategy execution even when your computer is offline.

Chart Configuration for Optimal Analysis

Set up multiple chart layouts displaying different timeframes simultaneously. The Takashi Kotegawa Strategy requires monitoring 1-minute, 5-minute, and 15-minute charts concurrently. Our platform supports unlimited chart windows with customizable arrangements.

Apply specific color schemes and indicator settings that enhance pattern recognition. Configure candlestick charts with appropriate scaling for precise price action analysis. Save custom templates for consistent chart setup across different trading sessions.

Order Management System Features

Our advanced order management system supports the rapid execution requirements of the Takashi Kotegawa Strategy. Place market orders, limit orders, and stop orders with single-click functionality. Configure trailing stops that automatically adjust as positions move favorably.

Set up one-cancels-other (OCO) orders for simultaneous profit-taking and loss-limiting. Our system processes orders with minimal slippage, crucial for the precise entry and exit points required by this strategy.

Risk Management Implementation

The Takashi Kotegawa Strategy emphasizes strict risk management protocols that our platform fully supports. Configure position sizing calculators that automatically determine appropriate trade sizes based on account equity and risk parameters. Set maximum daily loss limits to protect your trading capital.

Our risk management tools include real-time margin monitoring and automatic position closure when predetermined risk levels are reached. Configure alerts for margin level warnings and equity drawdown thresholds. These features ensure disciplined adherence to the Takashi Kotegawa Strategy's risk management principles.

Implement stop-loss orders at precise levels calculated according to the Takashi Kotegawa Strategy methodology. Our platform supports guaranteed stop-loss orders on selected instruments, providing additional protection during volatile market conditions.

The following risk management features support strategy implementation:

- Automatic position sizing based on account equity

- Real-time margin monitoring with customizable alerts

- Guaranteed stop-loss orders for enhanced protection

- Daily loss limits with automatic trading suspension

- Equity drawdown notifications and controls

Market Analysis Tools and Indicators

Our platform provides comprehensive market analysis tools essential for the Takashi Kotegawa Strategy. Access real-time market sentiment indicators, economic calendar integration, and news feed updates. These tools help identify market conditions favorable for strategy implementation.

Configure custom watchlists containing instruments that exhibit the volatility characteristics suitable for this trading approach. Our market scanner identifies stocks and forex pairs showing momentum patterns consistent with the Takashi Kotegawa Strategy requirements.

| Analysis Tool | Function | Update Frequency |

|---|---|---|

| Market Scanner | Pattern identification | Real-time |

| Economic Calendar | News impact assessment | Continuous |

| Sentiment Indicators | Market mood analysis | Live updates |

| Volume Analysis | Liquidity measurement | Tick-by-tick |

Technical Indicator Configuration

Set up moving average combinations that signal momentum changes according to the Takashi Kotegawa Strategy. Configure exponential moving averages with periods of 5, 10, and 20 for short-term trend identification. Apply volume-weighted average price (VWAP) indicators for institutional-level analysis.

Customize RSI settings with overbought and oversold levels adjusted for intraday trading. Set up MACD indicators with optimized parameters for detecting momentum shifts. Our platform supports unlimited indicator combinations on single charts.

Pattern Recognition Systems

Our advanced pattern recognition algorithms identify chart formations consistent with the Takashi Kotegawa Strategy. Configure alerts for breakout patterns, flag formations, and momentum reversals. The system automatically highlights potential entry and exit points based on predefined criteria.

Access proprietary pattern recognition tools developed specifically for our platform. These tools analyze price action in real-time and provide visual signals when strategy conditions are met. Customize sensitivity settings to match your trading preferences.

Execution Strategies and Order Types for the Takashi Kotegawa Strategy

The Takashi Kotegawa Strategy requires precise order execution capabilities that our platform delivers consistently. Utilize market orders for immediate execution during breakout scenarios. Configure limit orders for entry at specific price levels identified through technical analysis.

Our advanced order types include iceberg orders for large position management and time-in-force options for controlling order duration. Set up bracket orders that automatically place profit targets and stop-losses simultaneously with entry orders.

Implement algorithmic trading strategies through our Expert Advisor functionality. Program specific rules based on the Takashi Kotegawa Strategy methodology for automated execution. Our backtesting environment allows strategy validation before live implementation.

Order Execution Optimization

Configure order execution preferences to minimize slippage and maximize fill rates. Our smart order routing technology selects optimal execution venues for each trade. Set up partial fill handling to manage large positions effectively.

Utilize our direct market access (DMA) capabilities for institutional-grade execution. Configure pre-trade risk checks that prevent orders violating strategy parameters. Our system provides real-time execution reports for performance analysis.

Performance Monitoring and Analysis

Track strategy performance through our comprehensive reporting system designed for the Takashi Kotegawa Strategy implementation. Monitor key metrics including win rate, average profit per trade, and maximum drawdown. Our analytics dashboard provides real-time performance updates, crucial for adapting the Takashi Kotegawa Strategy to changing market conditions.

Configure custom performance reports that align with strategy-specific metrics. Track daily, weekly, and monthly performance statistics. Our system calculates risk-adjusted returns and provides detailed trade analysis.

The following performance metrics are essential for strategy evaluation:

- Win rate percentage and profit factor calculations

- Average holding time and trade frequency analysis

- Maximum drawdown and recovery time measurements

- Risk-adjusted return calculations and Sharpe ratios

- Monthly and quarterly performance comparisons

| Performance Metric | Calculation Method | Reporting Frequency |

|---|---|---|

| Win Rate | Profitable trades / Total trades | Real-time |

| Profit Factor | Gross profit / Gross loss | Daily |

| Sharpe Ratio | Risk-adjusted returns | Monthly |

| Maximum Drawdown | Peak-to-trough decline | Continuous |

Trade Journal Integration

Maintain detailed trade records through our integrated journal system. Record entry and exit rationale for each trade based on the Takashi Kotegawa Strategy signals. Our system automatically captures trade execution data and market conditions.

Configure custom fields for strategy-specific information including setup quality, market conditions, and emotional state. Export trade data for external analysis and tax reporting purposes. Our journal supports image attachments for chart screenshots and analysis notes.

Advanced Features and Customization

Our platform offers advanced customization options that enhance the Takashi Kotegawa Strategy implementation. Configure custom indicators using our MQL programming language. Develop proprietary tools that align with your specific interpretation of the Takashi Kotegawa Strategy.

Access our API for integration with external analysis tools and data providers. Configure automated reporting systems that track strategy performance and send updates to your preferred communication channels. Our platform supports third-party plugin integration for enhanced functionality.

Utilize our cloud-based infrastructure for seamless access across multiple devices. Synchronize platform settings, custom indicators, and trading templates across desktop and mobile applications. Our system maintains consistent performance regardless of access method.

Mobile Trading Capabilities

Execute the Takashi Kotegawa Strategy through our mobile applications available for iOS and Android devices. Access full charting capabilities with touch-optimized interfaces. Configure push notifications for strategy-specific alerts and market updates.

Our mobile platform maintains feature parity with desktop versions while optimizing for touch-based interaction. Execute trades, monitor positions, and analyze markets from anywhere with internet connectivity. Biometric authentication ensures secure access to your trading account.

The comprehensive implementation of the Takashi Kotegawa Strategy through our FxPro platform provides South African traders with institutional-grade tools and execution capabilities. Our regulatory compliance with FSCA requirements ensures secure trading while our advanced technology supports the precise execution demands of this legendary trading methodology.

FAQ

- What is the Takashi Kotegawa Strategy?

- It is a successful day trading methodology focusing on momentum breakouts, risk management, and intraday price movements developed by a renowned Japanese trader.

- Which platforms support this strategy with FxPro?

- MetaTrader 4, MetaTrader 5, and cTrader platforms support the implementation of the Takashi Kotegawa Strategy with FxPro.

- How fast is order execution on FxPro?

- Order execution speeds average 0.03 seconds, ensuring rapid trade processing aligned with strategy demands.

- Can I automate parts of the strategy?

- Yes, using Expert Advisor functionality you can automate entry and exit rules based on the Takashi Kotegawa Strategy.

- Is the platform compliant with South African regulations?

- Yes, FxPro complies with FSCA regulations to ensure secure and regulated trading for South African clients.