Key Takeaways

- FxPro adheres to stringent KYC protocols, a regulatory standard ensuring your account's security in South Africa.

- Successful verification hinges on three document types: proof of identity, residence, and payment method.

- While standard verification is completed within 24-72 hours, complete and accurate submissions can expedite the process.

Table of Contents

Understanding How to Verify FxPro Account: Key Requirements

To ensure the highest level of security and comply with Financial Sector Conduct Authority (FSCA) regulations, FxPro requires all clients in South Africa to complete a mandatory verification process. This industry-standard Know Your Customer (KYC) protocol is designed to protect your funds and maintain the integrity of the trading platform.

The process is straightforward and requires three primary categories of documents: proof of identity, proof of residence, and proof of your payment method. Each document must meet specific criteria for format, clarity, and validity to ensure a smooth review. Submitting clear documents is the first step in learning **how to verify FxPro account** quickly.

| Document Type | Accepted Formats | File Size Limit | Validity Period |

|---|---|---|---|

| Identity Proof | PDF, JPG, PNG | 5MB maximum | Current/unexpired |

| Address Proof | PDF, JPG, PNG | 5MB maximum | Issued within 3 months |

| Payment Proof | PDF, JPG, PNG | 5MB maximum | Issued within 6 months |

Preparing Your Required Documentation

Identity Verification Documents

For South African clients, a primary identity document is required. We accept South African ID books, modern smart ID cards, or valid passports. While a driver's license can be used, it may require additional supporting documentation to be accepted.

Ensure your document images are sharp and capture all four corners, free from shadows or glare. All text must be clearly legible, and the colors should be accurate. If you are submitting a scan, it may require certification from an authorized official.

Proof of Residence Requirements

Your address verification document must clearly show your full name and current residential address. Accepted documents include utility bills (water, electricity, gas), bank statements, or municipal rate notices issued within the last three months. Please note that P.O. Box addresses are not accepted.

Accessing the Secure Verification Portal

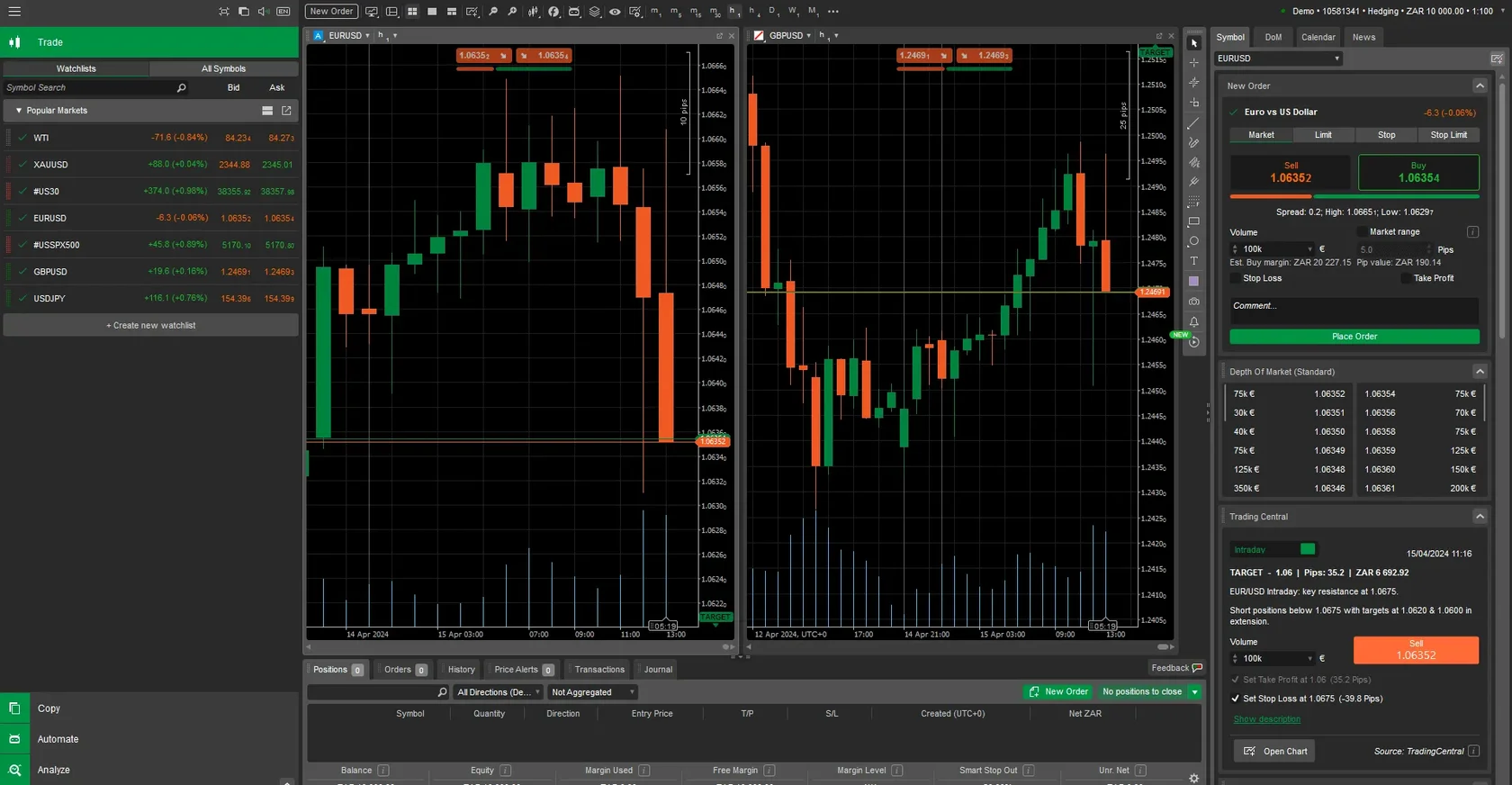

Once you've prepared your documents, log in to your FxPro client portal and navigate to the "Account Verification" section. The dashboard provides a clear overview of your verification status, with color-coded indicators for each document category: red for incomplete, yellow for pending review, and green for approved.

The portal features a user-friendly drag-and-drop interface, allowing you to upload your files quickly and efficiently. You can monitor the upload progress and will receive an email confirmation once your documents are successfully submitted to our system.

The Document Upload Process Explained

File Format Specifications

We accept documents in JPEG, PNG, and PDF formats. For optimal clarity, images should have a resolution of at least 300 DPI. Ensure any compression used does not compromise the legibility of the text.

Upload Procedure Steps

Simply select the correct document category, choose the file from your device, and preview it to ensure it's clear. Add any relevant comments in the notes field and click "Upload Document." You will receive on-screen and email confirmations upon successful submission.

Identity Document Submission Guidelines

For successful verification, place your ID on a flat, well-lit surface to avoid shadows and reflections. For Smart ID cards, you must upload clear images of both the front and back. For passports, the main information page with your photo and personal details is required.

| ID Document Type | Required Pages | Special Notes | Processing Time |

|---|---|---|---|

| SA ID Book | Photo page only | Must be current | 24-48 hours |

| Smart ID Card | Front and back | Both sides required | 24-48 hours |

| Passport | Main info page | Must be valid | 48-72 hours |

Common Verification Issues and Solutions

The most common reason for rejection is poor document quality. Blurry, poorly lit, or cropped images will be automatically rejected. Always double-check your files before uploading. Additionally, ensure all documents are current and not expired.

Discrepancies between the name on your documents and your account registration will also cause delays. Understanding these common pitfalls is crucial for anyone learning **how to verify FxPro account** without issues. If you encounter any problems, our dedicated support team is available via live chat to assist you.

Frequently Asked Questions

- What documents are required for FxPro account verification in South Africa?

- You need to submit valid proof of identity (ID card, passport), proof of residence (utility bill, bank statement), and proof of your payment method.

- How long does the FxPro verification process take?

- Standard processing is typically completed within 24 to 72 hours, provided all documents are submitted correctly and meet the requirements.

- Can I use a driver's license for identity verification?

- A driver's license may be accepted but often requires additional supporting documents. An ID book, smart ID card, or passport is preferred for faster processing.

- What should I do if my documents are rejected?

- The system will provide a reason for the rejection. Carefully review the feedback, correct the issue (e.g., by taking a clearer picture or providing a different document), and resubmit through the verification portal.