Key Takeaways

- Minimum withdrawal limits vary by payment method with specific thresholds in ZAR.

- Verification and compliance ensure secure and regulated withdrawal processing.

- Processing times depend on the withdrawal method and business day schedules.

Table of Contents

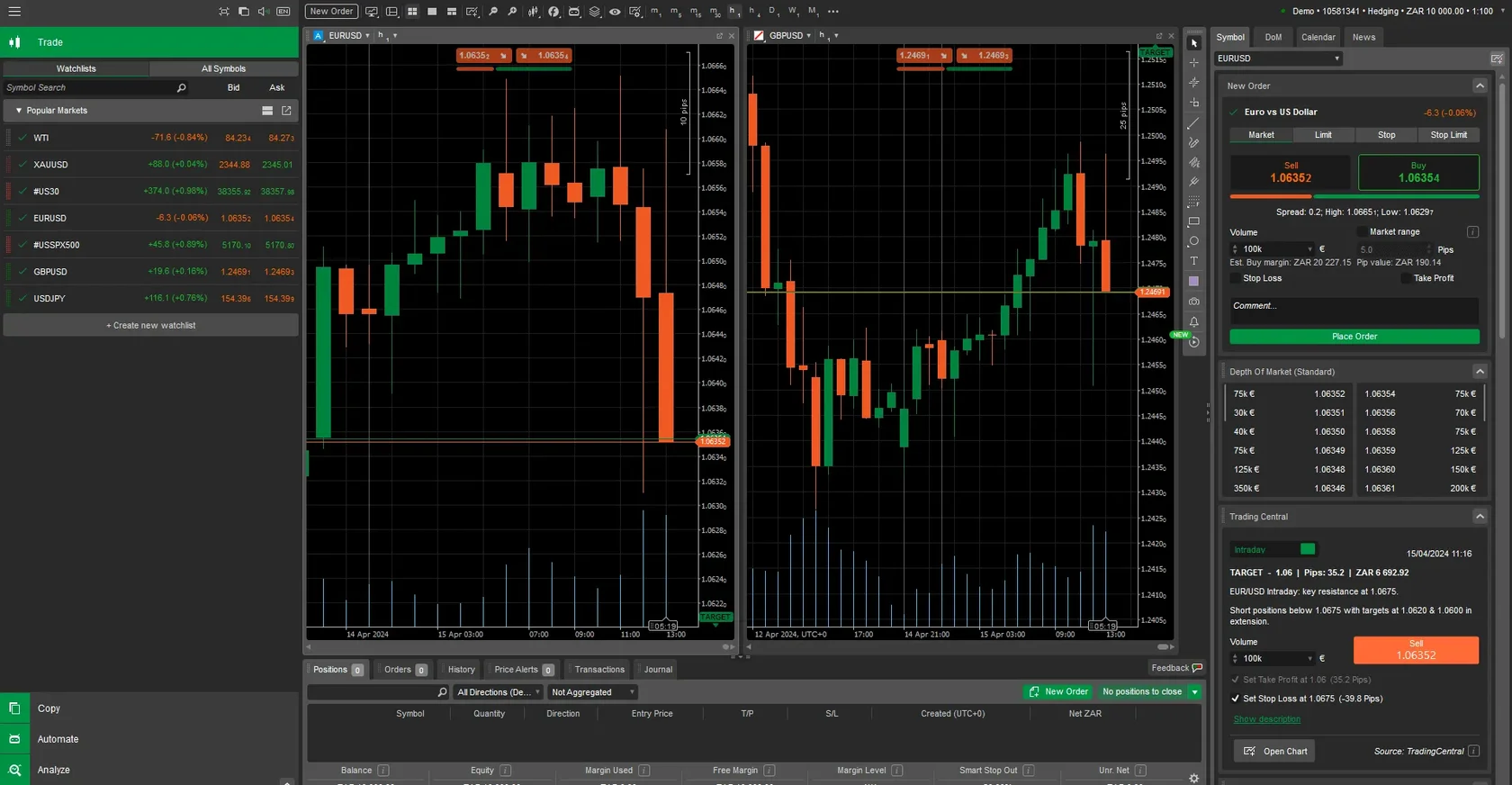

Understanding FxPro Withdrawal Fundamentals

Our company maintains specific withdrawal protocols designed for South African traders. The minimum withdrawal amount varies depending on your chosen payment method and account type. We process withdrawals through multiple channels to accommodate different banking preferences across South Africa.

The standard minimum withdrawal threshold starts at $10 USD equivalent in South African Rand. This applies to most electronic payment methods including credit cards and e-wallets. Bank wire transfers require higher minimum amounts due to processing costs and intermediary bank fees.

Processing times differ significantly between payment methods. Electronic withdrawals typically complete within 1-3 business days. Traditional bank transfers may require 3-7 business days depending on your specific South African bank's processing schedule.

Withdrawal Method Comparison:

- Credit/Debit Cards: R150 minimum, 1-3 business days

- Bank Wire Transfer: R1,500 minimum, 3-7 business days

- Skrill: R100 minimum, 24 hours processing

- Neteller: R100 minimum, 24 hours processing

- Perfect Money: R50 minimum, instant processing

We verify all withdrawal requests through our compliance department before processing. This ensures adherence to South African financial regulations and protects your account security.

| Payment Method | Minimum Amount (ZAR) | Processing Time | Daily Limit |

|---|---|---|---|

| Credit Cards | R150 | 1-3 days | R50,000 |

| Bank Transfer | R1,500 | 3-7 days | R200,000 |

| E-wallets | R100 | 24 hours | R75,000 |

Account Verification Requirements

Document Submission Process

Our verification system requires specific documentation from South African residents. You must upload a clear copy of your South African ID document or valid passport. The document should display all four corners without any cropping or editing.

Proof of address documentation must be dated within the last three months. Acceptable documents include municipal bills, bank statements, or official correspondence from recognized South African institutions. We do not accept mobile phone bills or insurance statements.

Bank verification requires uploading a bank statement showing your name and account details. The statement must match the withdrawal method you intend to use. This prevents unauthorized access and ensures compliance with anti-money laundering regulations.

Processing Timeline Expectations

Verification typically completes within 24-48 hours during business days. Our compliance team reviews documents manually to ensure authenticity and completeness. Incomplete submissions may delay the process by an additional 2-3 business days.

Once verified, your account receives permanent approval status. Future withdrawals process automatically without additional documentation requirements. This streamlines subsequent transactions and reduces waiting times significantly.

Step-by-Step Withdrawal Instructions

Accessing the Withdrawal Interface

Log into your FxPro trading account using your registered credentials. Navigate to the "My Account" section located in the main dashboard menu. Select "Withdraw Funds" from the available financial operations list.

The withdrawal interface displays your current account balance and available withdrawal amount. Available funds exclude any amounts tied to open positions or pending orders. Margin requirements also affect the withdrawable balance calculation.

Choose your preferred withdrawal method from the dropdown menu. The system automatically displays minimum and maximum limits for your selected option. Processing fees (if applicable) appear before you confirm the transaction.

Completing the Withdrawal Request

Enter the withdrawal amount ensuring it meets the minimum threshold requirements. The system converts amounts automatically between USD and ZAR using current exchange rates. Review the conversion rate before confirming your request.

Provide the required payment details for your chosen withdrawal method. Bank transfers require your complete banking information including branch codes and account numbers. E-wallet withdrawals need your registered wallet email address.

Required Information Checklist:

- Withdrawal amount (meeting minimum requirements)

- Payment method selection

- Complete banking or e-wallet details

- Transaction reference (optional but recommended)

- Confirmation of terms and conditions

Submit the withdrawal request and note the generated transaction reference number. This reference helps track your withdrawal status and resolve any potential issues with our support team.

Payment Method Specifications

Different withdrawal options serve various trader preferences and banking relationships in South Africa. Credit and debit card withdrawals return funds to the original deposit source. This policy complies with international financial regulations and prevents unauthorized transactions.

Bank wire transfers offer the highest withdrawal limits but require longer processing times. South African banks may charge receiving fees ranging from R50 to R200 depending on your banking institution. These fees are separate from any charges applied by our company.

E-wallet solutions provide the fastest processing times with competitive exchange rates. Skrill and Neteller maintain strong presence in South Africa with local customer support. Perfect Money offers instant processing but has limited acceptance among South African financial institutions.

| Feature | Cards | Bank Wire | E-wallets |

|---|---|---|---|

| Speed | Medium | Slow | Fast |

| Limits | Medium | High | Medium |

| Fees | Low | Medium | Low |

| Convenience | High | Low | High |

Processing Times and Schedules

Business Day Calculations

Our processing schedule follows South African business days excluding public holidays. Withdrawal requests submitted before 14:00 SAST receive same-day processing consideration. Requests after this cutoff time process on the following business day.

Weekend submissions queue for Monday processing unless Monday falls on a public holiday. South African public holidays may extend processing times by one additional business day. We notify clients of any holiday-related delays through email notifications.

Expedited Processing Options

Priority processing is available for verified accounts with trading history exceeding six months. This service reduces standard processing times by approximately 50% across all payment methods. Priority status applies automatically based on account activity and verification status.

Large withdrawal amounts exceeding R100,000 may require additional verification steps. Our compliance team contacts clients directly to confirm transaction legitimacy. This process typically adds 1-2 business days to standard processing times but ensures maximum security.

Fees and Exchange Rates

We apply transparent fee structures for all withdrawal methods serving South African clients. Credit card withdrawals incur no processing fees for amounts exceeding the minimum threshold. Smaller withdrawals may be subject to a flat R25 processing charge.

Bank wire transfers include a standard R150 processing fee regardless of withdrawal amount. This fee covers intermediary bank charges and international transfer costs. Your receiving bank may apply additional charges beyond our control.

Fee Structure Breakdown:

- Credit/Debit Cards: Free above R150, R25 below minimum

- Bank Transfers: R150 flat fee per transaction

- Skrill: 1.5% of withdrawal amount

- Neteller: 1.5% of withdrawal amount

- Perfect Money: 0.5% of withdrawal amount

Exchange rates update every 15 minutes during market hours using institutional banking rates. We add a 0.5% spread to cover currency conversion costs and market volatility protection. This rate remains competitive compared to traditional South African banks.

Troubleshooting Common Issues

Delayed Withdrawal Resolution

Delayed withdrawals often result from incomplete verification documentation or banking information errors. Check your email for any verification requests from our compliance team. Respond promptly with requested documentation to avoid further delays.

Banking details must match exactly with your verified account information. Incorrect account numbers or branch codes cause automatic rejection and require resubmission. Double-check all numerical entries before confirming withdrawal requests.

Failed Transaction Recovery

Failed withdrawals typically return to your trading account within 24 hours. The system generates automatic notifications explaining the failure reason and required corrective actions. Common causes include insufficient funds, expired payment methods, or banking restrictions.

Contact our South African support team immediately if withdrawals fail repeatedly. Provide your transaction reference numbers and account verification status. Our technical team can identify specific issues and provide targeted solutions for your situation.

| Issue Type | Resolution Time | Required Action |

|---|---|---|

| Documentation | 24-48 hours | Upload missing documents |

| Banking Error | 1-3 days | Verify account details |

| Technical | 4-6 hours | Contact support team |

| Compliance | 2-5 days | Additional verification |

Security and Compliance Measures

Our withdrawal security employs multiple authentication layers protecting South African traders' funds. Two-factor authentication becomes mandatory for all withdrawal requests exceeding R10,000. This additional security step prevents unauthorized access even if login credentials become compromised.

SSL encryption protects all financial data transmission between your device and our servers. We maintain PCI DSS compliance ensuring credit card information receives maximum protection standards. Regular security audits verify system integrity and identify potential vulnerabilities.

Anti-money laundering protocols require withdrawal destinations to match verified deposit sources. This policy prevents fraudulent activities and ensures compliance with South African financial regulations. Unusual withdrawal patterns trigger automatic compliance reviews for account protection.

We maintain detailed transaction logs for all withdrawal activities. These records assist with dispute resolution and provide comprehensive audit trails. South African regulatory authorities can access these records when required for compliance investigations.

The FxPro Minimum Withdrawal system provides South African traders with flexible, secure access to their trading profits. Our comprehensive payment options, transparent fee structures, and robust security measures ensure reliable fund management. Understanding these withdrawal procedures enables efficient financial planning and seamless trading operations across South Africa's dynamic forex market.

FAQ

- What is the minimum withdrawal amount for FxPro traders in South Africa?

- The minimum withdrawal amount varies by payment method, starting at R50 for Perfect Money and up to R1,500 for bank wire transfers.

- How long does it take to process a withdrawal?

- Processing times depend on the method: electronic payments typically take 1-3 business days, while bank transfers can take 3-7 business days.

- What documents are required for account verification?

- South African ID or passport, proof of address dated within three months, and a bank statement matching the withdrawal method are required.

- Are there any fees for withdrawals?

- Fees vary by method: credit cards may be free above R150, bank transfers have a R150 fee, and e-wallets charge a percentage of the withdrawal amount.

- What should I do if my withdrawal is delayed or fails?

- Check your email for verification requests, ensure banking details are correct, and contact support with your transaction reference for assistance.