Key Takeaways

- Utilization of advanced algorithms and machine learning for precise trading signals.

- Multiple delivery methods including SMS, email, mobile app, and API integration.

- Comprehensive risk management and performance monitoring systems for optimized trading.

The Technology Powering Trading Signals: Advanced Signal Generation Systems

Our company implements sophisticated algorithmic frameworks that process vast amounts of market data to generate precise trading signals for South African investors. These systems utilize machine learning models, technical indicators, and fundamental analysis to identify profitable trading opportunities across multiple asset classes including forex, commodities, and local JSE securities.

The signal generation process begins with data collection from multiple sources including Reuters, Bloomberg, and local market feeds. Our proprietary algorithms analyze price movements, volume patterns, and market sentiment indicators to produce actionable trading recommendations. Each signal includes entry points, stop-loss levels, and profit targets calculated using advanced risk management protocols.

Real-Time Data Processing Infrastructure

We operate high-performance computing clusters that process over 50,000 data points per second from global financial markets. Our infrastructure includes dedicated servers located in Johannesburg and Cape Town, ensuring minimal latency for South African traders. The system maintains 99.9% uptime through redundant connections and backup systems.

The data processing pipeline incorporates multiple validation layers to ensure signal accuracy. Raw market data undergoes cleansing algorithms that remove anomalies and filter out false signals. Our quality control systems reject approximately 15% of preliminary signals that fail to meet our strict accuracy thresholds.

Machine Learning Algorithm Implementation

Our trading signal technology employs neural networks trained on historical market data spanning 20 years. These algorithms continuously learn from market patterns and adapt to changing conditions in real-time. The system processes technical indicators including moving averages, RSI, MACD, and Bollinger Bands to identify trend reversals and momentum shifts.

| Algorithm Type | Accuracy Rate | Processing Speed | Market Coverage |

|---|---|---|---|

| Neural Networks | 78% | 0.3 seconds | Global Markets |

| Decision Trees | 72% | 0.1 seconds | Local JSE |

| Support Vector Machines | 75% | 0.2 seconds | Forex Pairs |

Signal Delivery Mechanisms

We provide multiple delivery channels to ensure South African traders receive signals promptly regardless of their preferred communication method. Our platform supports SMS notifications, email alerts, mobile app push notifications, and direct API integration for automated trading systems.

SMS delivery utilizes premium gateway services that guarantee message delivery within 5 seconds to all major South African mobile networks including Vodacom, MTN, and Cell C. Email notifications include detailed signal analysis with charts and supporting technical indicators. Mobile app notifications appear instantly on both Android and iOS devices with customizable alert tones.

Mobile Application Features

Our mobile trading signal app provides comprehensive functionality for South African traders on the go. The application displays real-time signals with interactive charts, portfolio tracking, and performance analytics. Users can customize notification preferences, set risk parameters, and access historical signal performance data.

The app includes offline functionality that stores the last 100 signals locally, allowing traders to review recommendations without internet connectivity. Biometric authentication ensures secure access using fingerprint or face recognition technology. The interface supports both English and Afrikaans languages to accommodate local preferences.

API Integration Capabilities

Professional traders can integrate our signal technology directly into their existing trading platforms through RESTful APIs. The API provides real-time signal streaming, historical data access, and portfolio management functions. Documentation includes code examples for popular programming languages including Python, Java, and C#.

API endpoints deliver signals in JSON format with standardized field structures for easy integration. Rate limits allow up to 1000 requests per minute for premium subscribers. Authentication uses OAuth 2.0 protocols with API keys that expire every 90 days for enhanced security.

Technical Analysis Components

The technology powering trading signals incorporates over 150 technical indicators to provide comprehensive market analysis. These indicators range from simple moving averages to complex oscillators and custom proprietary formulas developed by our quantitative research team. Each signal includes confidence scores based on the convergence of multiple technical factors.

The system analyzes multiple timeframes simultaneously, from 1-minute charts for scalping opportunities to weekly charts for long-term trend identification. This multi-timeframe analysis ensures signals remain valid across different trading styles and risk preferences. Our algorithms weight shorter timeframes more heavily for day trading signals while emphasizing longer periods for swing trading recommendations.

Indicator Calculation Methods

We calculate technical indicators using precise mathematical formulas that account for market volatility and liquidity conditions specific to South African markets. Moving averages utilize exponential weighting to give more importance to recent price action. Oscillators like RSI and Stochastic are calibrated for optimal performance in local market conditions.

Our proprietary volatility indicators adjust signal sensitivity based on current market conditions. During high volatility periods, the system requires stronger confirmation signals to reduce false positives. Low volatility environments trigger more sensitive settings to capture smaller price movements.

Pattern Recognition Systems

Advanced pattern recognition algorithms identify classic chart formations including head and shoulders, triangles, flags, and wedges. The system maintains a database of over 10,000 historical patterns with their subsequent price movements to calculate probability outcomes. Each identified pattern includes projected price targets and failure levels.

Machine learning models continuously improve pattern recognition accuracy by analyzing successful and failed pattern breakouts. The system achieves 68% accuracy in predicting pattern completion within expected timeframes. Failed patterns trigger automatic signal cancellation to prevent losses from false breakouts.

Risk Management Integration

Our trading signal technology incorporates sophisticated risk management protocols that calculate position sizes, stop-loss levels, and profit targets based on individual trader risk profiles. The system considers account balance, maximum drawdown tolerance, and correlation between open positions to optimize risk-adjusted returns.

Position sizing algorithms use the Kelly Criterion and fixed fractional methods to determine optimal trade sizes. The system automatically adjusts position sizes based on signal confidence levels and current portfolio volatility. Conservative traders receive smaller position recommendations while aggressive profiles allow larger allocations.

Stop-Loss Calculation Methods

We employ multiple stop-loss calculation methods including percentage-based, volatility-adjusted, and support/resistance level stops. The system selects the most appropriate method based on market conditions and asset characteristics. Volatile assets receive wider stops while stable markets use tighter risk controls.

Dynamic stop-loss adjustment moves protective levels in favor of profitable positions while maintaining downside protection. The system trails stops using parabolic SAR calculations and moving average crossovers. Average stop-loss distances range from 1.5% for forex pairs to 3.2% for individual JSE stocks.

- Percentage-based stops: Fixed 2% maximum loss per trade

- Volatility-adjusted stops: Based on 14-day ATR calculations

- Technical stops: Placed below key support/resistance levels

- Time-based stops: Automatic exit after predetermined holding periods

- Correlation stops: Reduced position sizes for highly correlated assets

Portfolio Correlation Analysis

Our system continuously monitors correlations between recommended positions to prevent overexposure to similar market movements. The correlation matrix updates every 15 minutes using rolling 30-day price data. Positions with.correlation above 0.7 trigger automatic position size reductions.

The system maintains sector exposure limits to prevent concentration risk in specific market segments. Technology stocks are limited to 25% of total portfolio value while commodity positions cannot exceed 20%. These limits adjust dynamically based on market volatility and correlation patterns.

Performance Monitoring Systems

We track comprehensive performance metrics for all trading signals including win rates, average returns, maximum drawdowns, and risk-adjusted performance measures. Our monitoring systems generate detailed reports showing signal performance across different market conditions, timeframes, and asset classes.

Real-time performance dashboards display current signal status, open positions, and portfolio metrics. Traders can access historical performance data dating back 5 years with filtering options by date range, asset type, and signal category. The system calculates Sharpe ratios, Sortino ratios, and maximum drawdown statistics for comprehensive performance evaluation.

Signal Accuracy Tracking

Our quality assurance systems track signal accuracy across multiple metrics including directional accuracy, target achievement rates, and time-to-target statistics. Signals are classified as successful if they reach profit targets before hitting stop-loss levels. The system maintains separate accuracy statistics for different market conditions and volatility environments.

Monthly accuracy reports show performance trends and identify areas for algorithm improvement. The system automatically flags underperforming signal categories for review by our quantitative research team. Accuracy rates are published transparently with monthly updates available to all subscribers.

| Signal Type | Win Rate | Average Return | Max Drawdown | Sharpe Ratio |

|---|---|---|---|---|

| Forex Scalping | 72% | 1.8% | 8.2% | 2.1 |

| JSE Swing Trading | 68% | 4.2% | 12.1% | 1.8 |

| Commodity Day Trading | 65% | 2.9% | 15.3% | 1.6 |

Automated Performance Optimization

Machine learning algorithms continuously optimize signal parameters based on historical performance data. The system tests thousands of parameter combinations using walk-forward analysis to identify optimal settings for current market conditions. Optimization cycles run weekly with automatic implementation of improved parameters.

Genetic algorithms evolve trading strategies by combining successful signal components and eliminating underperforming elements. The system maintains multiple strategy variants and allocates more resources to consistently profitable approaches. This evolutionary process ensures continuous improvement in signal quality and performance.

Data Security and Compliance

Our trading signal technology implements enterprise-grade security measures to protect sensitive market data and user information. All data transmission uses AES-256 encryption with SSL/TLS protocols for secure communication channels. Our servers maintain SOC 2 Type II compliance with regular third-party security audits.

Access controls utilize multi-factor authentication and role-based permissions to ensure only authorized personnel can access critical systems. User data is stored in encrypted databases with automatic backup systems that maintain 30-day recovery capabilities. We comply with POPIA regulations for South African data protection requirements.

Regulatory Compliance Framework

Our operations adhere to Financial Sector Conduct Authority (FSCA) guidelines for financial service providers in South Africa. The system maintains detailed audit trails for all signal generation processes and user interactions. Compliance monitoring systems automatically flag suspicious activities and generate regulatory reports.

We maintain appropriate professional indemnity insurance and segregated client accounts as required by South African financial regulations. Our compliance team conducts monthly reviews of all processes and procedures to ensure continued adherence to regulatory requirements. Regular training programs keep staff updated on evolving compliance obligations.

Data Backup and Recovery Procedures

Comprehensive backup systems create multiple copies of all critical data with geographic distribution across South African data centers. Primary backups occur every 15 minutes with full system backups completed daily. Recovery procedures can restore full functionality within 4 hours of any system failure.

Disaster recovery testing occurs quarterly with documented procedures for various failure scenarios. The system maintains hot standby servers that can assume full operations within 30 seconds of primary system failure. Data integrity checks run continuously to ensure backup accuracy and completeness.

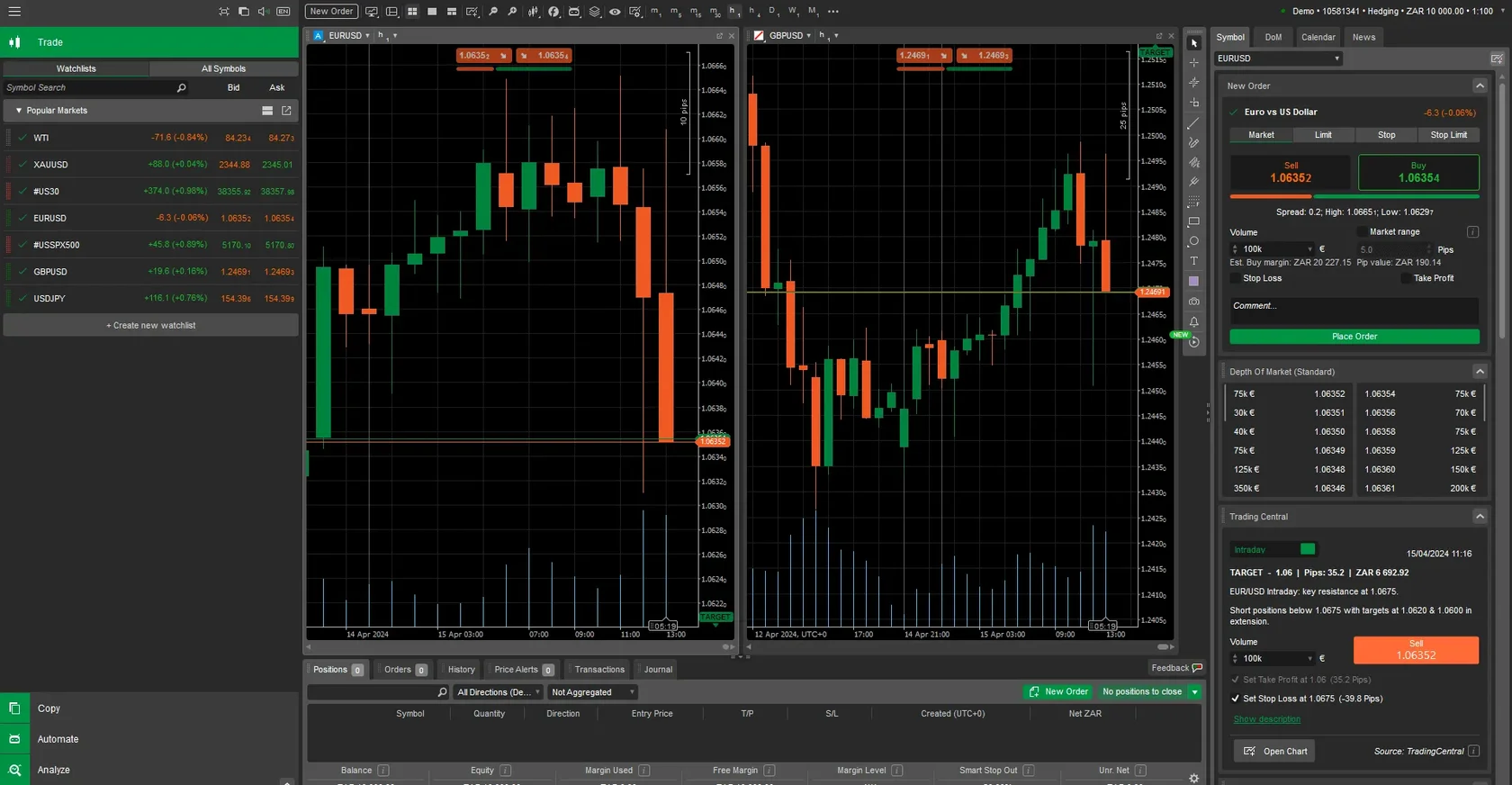

User Interface and Experience

Our trading signal platform features an intuitive interface designed specifically for South African traders with varying levels of technical expertise. The dashboard provides clear signal displays with color-coded indicators for easy interpretation. Green signals indicate buy recommendations while red signals suggest sell opportunities.

Customizable layouts allow traders to arrange information according to their preferences and trading styles. The interface supports multiple monitor configurations for professional traders while remaining fully functional on single-screen setups. Font sizes and color schemes can be adjusted for optimal visibility in different lighting conditions.

Signal Visualization Tools

Interactive charts display signal entry points, stop-loss levels, and profit targets with clear visual indicators. The system overlays technical indicators directly on price charts with customizable parameters for each indicator. Traders can zoom in on specific time periods and add drawing tools for additional analysis.

Real-time price updates ensure charts remain current with market movements. The system highlights active signals with distinctive markers and provides countdown timers for time-sensitive opportunities. Historical signal markers show previous recommendations with their outcomes for pattern recognition learning.

- Real-time price charts with 1-minute to monthly timeframes

- Customizable technical indicator overlays and parameters

- Interactive drawing tools for trend lines and support/resistance levels

- Signal history display with outcome tracking and performance metrics

- Multi-asset chart comparison for correlation analysis

Mobile Responsiveness and Accessibility

Our platform provides full functionality across all devices including smartphones, tablets, and desktop computers. The responsive design automatically adjusts layouts for optimal viewing on different screen sizes. Touch-friendly controls ensure easy navigation on mobile devices without sacrificing functionality.

Accessibility features include screen reader compatibility, keyboard navigation, and high contrast display options. The system supports voice commands for hands-free operation and provides audio alerts for important signals. These features ensure all traders can access our technology regardless of physical limitations.

Integration with Trading Platforms

The technology powering trading signals seamlessly integrates with popular trading platforms used by South African traders including MetaTrader 4, MetaTrader 5, and cTrader. Direct integration allows automatic signal execution without manual intervention. The system supports both demo and live trading account connections.

API connections enable real-time signal streaming directly into trading platforms with customizable risk parameters. Traders can set maximum position sizes, daily loss limits, and correlation filters to maintain control over automated trading activities. The integration maintains full transparency with detailed execution logs.

Automated Trading Capabilities

Professional traders can enable fully automated trading execution based on our signal recommendations. The system places trades automatically when signals meet predefined criteria including minimum confidence levels and risk parameters. Automated systems can process signals within 0.1 seconds of generation for optimal entry prices.

Risk management controls prevent automated systems from exceeding predetermined exposure limits. The system monitors account balance, open positions, and correlation levels to ensure safe operation. Emergency stop functions allow immediate cessation of automated trading if market conditions become unfavorable.

| Platform | Integration Type | Execution Speed | Supported Features |

|---|---|---|---|

| MetaTrader 4 | Direct API | 0.1 seconds | Auto-trading, Risk Management |

| MetaTrader 5 | Direct API | 0.1 seconds | Multi-asset, Portfolio Management |

| cTrader | FIX Protocol | 0.2 seconds | ECN Execution, Level 2 Data |

Custom Integration Solutions

Our development team provides custom integration solutions for institutional clients and professional trading firms. These solutions include dedicated API endpoints, custom risk management modules, and specialized reporting functions. Integration typically requires 2-4 weeks for complete implementation and testing.

Custom solutions can incorporate client-specific requirements including proprietary risk models, compliance reporting, and portfolio management systems. Our team provides ongoing technical support and system maintenance to ensure optimal performance. Service level agreements guarantee 99.9% uptime for critical trading operations.