Key Takeaways

- Islamic Halal accounts offer interest-free trading fully compliant with Sharia law.

- Account holders benefit from no-swap (swap-free) trading and access to a range of halal investment instruments.

- FxPro provides full access to its powerful platforms, competitive trading conditions, and dedicated support for Islamic account clients.

Table of Contents

- A Deeper Look: What is Islamic Halal Account in FxPro?

- Core Sharia Compliance Features in FxPro Islamic Accounts

- How to Open an Islamic Halal Account with FxPro

- Trading Conditions for Islamic Accounts

- Platform Access and Advanced Trading Tools

- Secure Deposit and Withdrawal Methods

- Dedicated Customer Support for Islamic Accounts

- Regulatory Compliance and Security of Funds

A Deeper Look: What is Islamic Halal Account in FxPro?

FxPro delivers Islamic Halal accounts specifically engineered for Muslim traders in South Africa who require Sharia-compliant trading solutions. These accounts fundamentally eliminate interest-based transactions, swap charges, and any riba elements that conflict with Islamic financial principles. We have structured our Islamic accounts to adhere strictly to Sharia law while granting traders full access to global forex trading opportunities.

The core feature of an Islamic Halal account is the absence of overnight interest charges on leveraged positions. While traditional forex accounts charge or credit swap fees for positions held overnight, our Islamic accounts remove these interest-based mechanics entirely. This approach guarantees compliance with the Islamic banking prohibition against earning or paying interest (riba).

South African Muslim traders gain access to the same extensive range of trading instruments available in standard accounts, including major currency pairs, commodities, indices, and precious metals. The trading conditions remain highly competitive, featuring tight spreads and rapid execution speeds. Our Islamic accounts provide a professional-grade trading environment without compromising on religious requirements.

| Account Feature | Islamic Halal Account | Standard Account |

|---|---|---|

| Swap Charges | No overnight fees (Swap-free) | Interest charged/paid |

| Trading Instruments | Full access | Full access |

| Leverage | Up to 1:30 (retail) | Up to 1:30 (retail) |

| Minimum Deposit | $100 USD | $100 USD |

| Commission Structure | Spread-based | Spread-based |

Core Sharia Compliance Features in FxPro Islamic Accounts

We ensure our Islamic Halal accounts meet stringent Sharia compliance standards through a carefully structured framework of trading conditions. Our accounts are designed to eliminate riba (interest), gharar (excessive uncertainty), and maysir (gambling). We consult with Islamic finance scholars to maintain unwavering compliance with all religious requirements.

The No-Swap Trading Mechanism

Our no-swap policy applies universally to all trading instruments available in Islamic accounts. Currency pairs, commodities, and indices can be traded without incurring any overnight interest charges. FxPro absorbs the cost of maintaining these positions, ensuring clients are never charged swap fees. This approach guarantees complete compliance with Islamic banking principles.

Halal Investment Instruments

We provide access to a wide array of Sharia-compliant trading instruments through our Islamic accounts. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are readily available for trading. Commodity markets, including gold, silver, and oil, offer halal investment opportunities that align with Islamic principles of tangible asset trading.

Explore Sharia-Compliant TradingHow to Open an Islamic Halal Account with FxPro

The registration process for an Islamic account is as secure and straightforward as for a standard account. South African residents must provide valid identification documents and proof of address. During the application, we require an additional confirmation of your need for an Islamic account. This step ensures the proper setup for Sharia compliance from the very beginning.

Account Verification Process

We implement comprehensive verification procedures for all Islamic account applications. Our compliance team meticulously reviews all documentation to ensure proper identity confirmation. South African residents must provide clear, legible copies of their identification documents. We verify address details through recent utility bills or bank statements to ensure regulatory adherence.

Initial Deposit Requirements

Our Islamic accounts require a minimum initial deposit of just $100 USD (or its equivalent). South African traders can fund their accounts using local bank transfers, credit/debit cards, or various electronic payment methods. We support deposits in South African Rand (ZAR) with automatic conversion to the account's base currency at competitive rates.

Start Your Application NowTrading Conditions for Islamic Accounts

Our Islamic Halal accounts offer highly competitive trading conditions while ensuring full Sharia compliance. Spreads remain tight across major currency pairs, with typical EUR/USD spreads starting from 1.2 pips. We provide ultra-fast order execution, with average speeds under 50 milliseconds. These conditions mirror our standard account offerings, ensuring no compromise on performance for religious compliance.

| Currency Pair | Typical Spread | Leverage (Retail) | Leverage (Professional) |

|---|---|---|---|

| EUR/USD | 1.2 pips | 1:30 | 1:500 |

| GBP/USD | 1.8 pips | 1:30 | 1:500 |

| USD/JPY | 1.4 pips | 1:30 | 1:500 |

| AUD/USD | 1.6 pips | 1:30 | 1:500 |

| USD/CAD | 1.9 pips | 1:30 | 1:500 |

Commission Structure

We operate our Islamic accounts on a transparent, spread-based commission model without any additional hidden fees. Traders only pay the spread—the difference between the bid and ask prices. We do not charge separate commissions on individual trades. This clear pricing structure aligns perfectly with Islamic principles of transparent transaction costs.

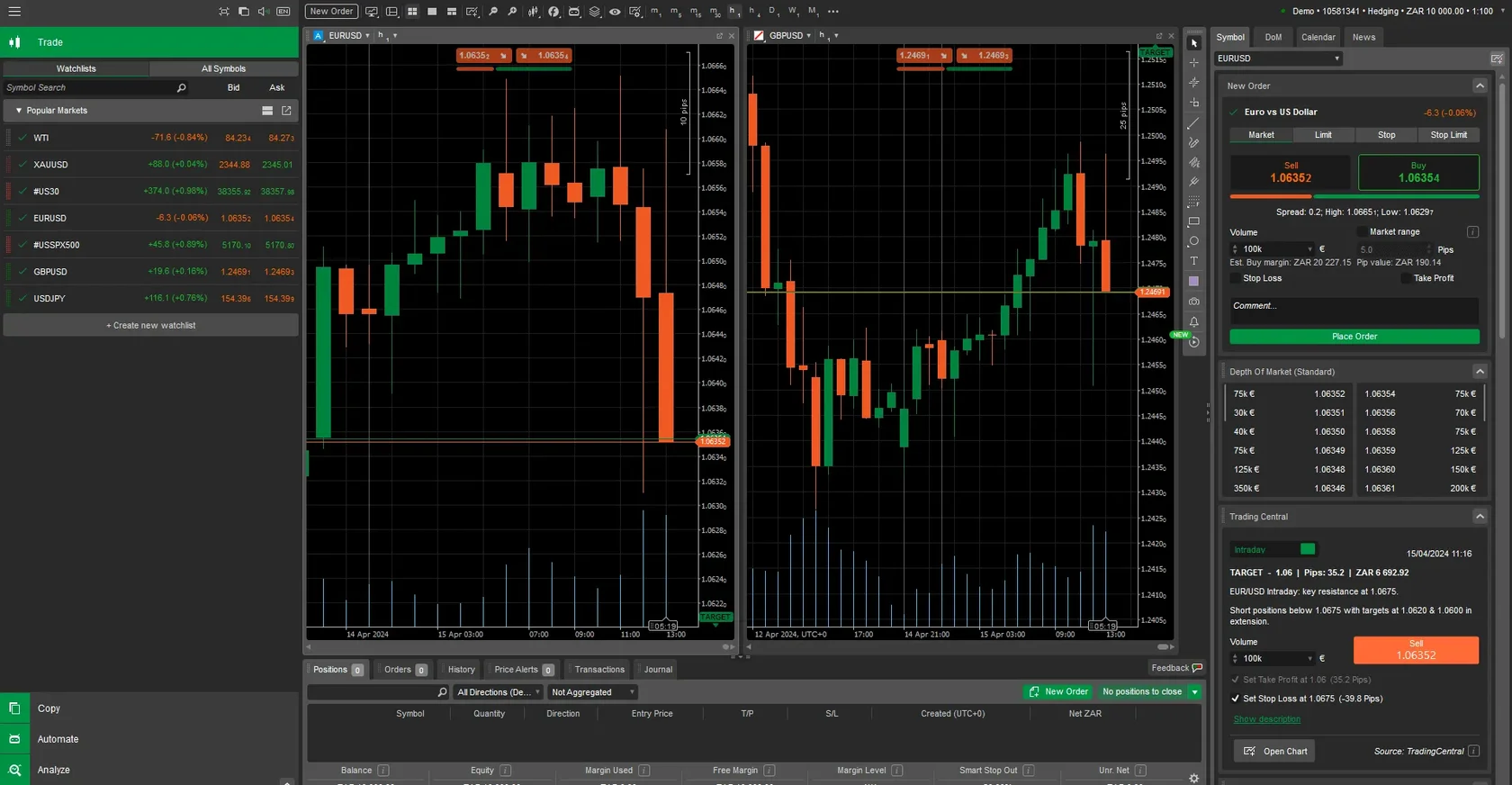

Platform Access and Advanced Trading Tools

Our Islamic account holders receive unrestricted access to the world-renowned MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These industry-standard platforms provide comprehensive charting tools, a vast library of technical indicators, and powerful automated trading capabilities. We guarantee that all platform features are fully available, ensuring the trading experience is identical to that of a standard account.

Key trading tools available for Islamic account holders include:

- Advanced charting with over 50 technical indicators

- An integrated Economic calendar with real-time market news

- Essential risk management tools, including stop-loss and take-profit orders

- Support for Expert Advisors (EAs) for automated trading strategies

- Market depth display for enhanced order execution visibility

- One-click trading functionality for rapid order placement

Secure Deposit and Withdrawal Methods

We support a multitude of secure and convenient funding options for Islamic accounts in South Africa. Local bank transfers allow for direct ZAR deposits at competitive exchange rates. We also accommodate international wire transfers in USD, EUR, and GBP. Credit and debit card payments offer instant funding for immediate trading access, while electronic wallets like Skrill and Neteller provide additional flexibility.

| Payment Method | Deposit Time | Withdrawal Time | Minimum Amount | Maximum Amount |

|---|---|---|---|---|

| Bank Transfer (ZAR) | 1 business day | 2-3 business days | R1,500 | R500,000 |

| Credit/Debit Card | Instant | 3-5 business days | $50 | $10,000 |

| Skrill | Instant | 1 business day | $10 | $10,000 |

| Neteller | Instant | 1 business day | $10 | $10,000 |

| Wire Transfer | 1-2 business days | 2-4 business days | $100 | $100,000 |

Dedicated Customer Support for Islamic Accounts

Our dedicated support team provides specialized assistance for Islamic account holders in South Africa. We have staff expertly trained in Sharia compliance requirements and Islamic trading principles who understand the unique needs of Muslim traders. We offer professional support in both English and Arabic for clear and comprehensive communication.

Educational Resources

We provide a comprehensive library of educational materials specifically designed for Islamic trading. These resources include guides on Sharia-compliant trading strategies, risk management, video tutorials explaining platform features, and webinars covering market analysis techniques suitable for halal trading approaches.

Regulatory Compliance and Security of Funds

Our Islamic accounts operate under full regulatory oversight from the relevant financial authorities. We maintain strict compliance with South African financial regulations while ensuring adherence to Sharia law. This robust regulatory framework provides investor protection and complete operational transparency. Client funds are held in segregated accounts in tier-1 banks for maximum security and protection.

For South African Muslim traders seeking Sharia-compliant solutions, the question of what is Islamic Halal Account in FxPro is of paramount importance. Our comprehensive offering provides full forex trading access while maintaining strict religious compliance standards through our carefully structured no-swap policies and halal investment instruments.

Register Your Islamic Account TodayFrequently Asked Questions

- What is an Islamic Halal account at FxPro?

- An Islamic Halal account is a forex trading account designed to comply with Sharia law by eliminating interest (riba) and swaps, allowing Muslim traders to engage in the financial markets without violating Islamic principles.

- Are swap fees charged on Islamic accounts?

- No, Islamic accounts operate with a strict no-swap policy. No overnight interest or swap fees are ever charged on open positions.

- What is the minimum deposit requirement?

- The minimum initial deposit for an Islamic account is $100 USD or its equivalent. We support deposits in South African Rand (ZAR), which are converted automatically.

- Which trading platforms are available for Islamic account holders?

- Islamic account holders have full, unrestricted access to the MetaTrader 4 and MetaTrader 5 platforms, including desktop, web, and mobile applications for iOS and Android.

- How can I open an Islamic account with FxPro in South Africa?

- You can open an account by completing the standard online registration, providing valid identification and proof of address, and clearly selecting the Islamic (swap-free) account option during the application process.