Key Takeaways

- Stop loss orders are essential for disciplined risk management and protecting trades on the FxPro platform.

- FxPro offers a versatile range of stop loss types, including fixed, trailing, and guaranteed, across its MT4, MT5, and cTrader platforms.

- Effective stop loss placement is a blend of precise risk calculations, sharp technical analysis, and adherence to regulatory standards.

Table of Contents

- Understanding Stop Loss Functionality on FxPro Platform

- How to Set Stop Loss on FxPro: A Step-by-Step Guide

- Mobile Application Stop Loss Management

- Risk Management Calculations and Position Sizing

- Common Stop Loss Mistakes and How to Avoid Them

- Platform-Specific Stop Loss Features

- Regulatory Compliance and Stop Loss Requirements

- Advanced Stop Loss Optimization Techniques

Understanding Stop Loss Functionality on FxPro Platform

Stop loss orders are indispensable risk management tools within the FxPro trading ecosystem. These automated instructions act as your financial safeguard, closing positions when the market moves against you to a predetermined price level. Learning how to set stop loss on FxPro is a foundational skill for every trader using the platform. Our platform seamlessly integrates advanced stop loss mechanisms across the MetaTrader 4, MetaTrader 5, and cTrader interfaces.

The stop loss feature operates via real-time market monitoring systems. When an asset's price reaches your specified threshold, our execution engine automatically triggers a position closure. This critical function prevents emotional, in-the-moment trading decisions during volatile market conditions.

Types of Stop Loss Orders Available

FxPro supports multiple stop loss variations to suit diverse trading strategies:

- Fixed Stop Losses: These maintain a static price level throughout the life of a position.

- Trailing Stops: These dynamic orders adjust automatically as price moves in your favor, protecting accumulated profits while allowing for continued upside potential.

- Guaranteed Stop Losses (GSLO): GSLOs offer absolute protection against slippage during extreme market volatility, executing at your exact price regardless of market gaps. Note that premium charges apply for this service.

How to Set Stop Loss on FxPro: A Step-by-Step Guide

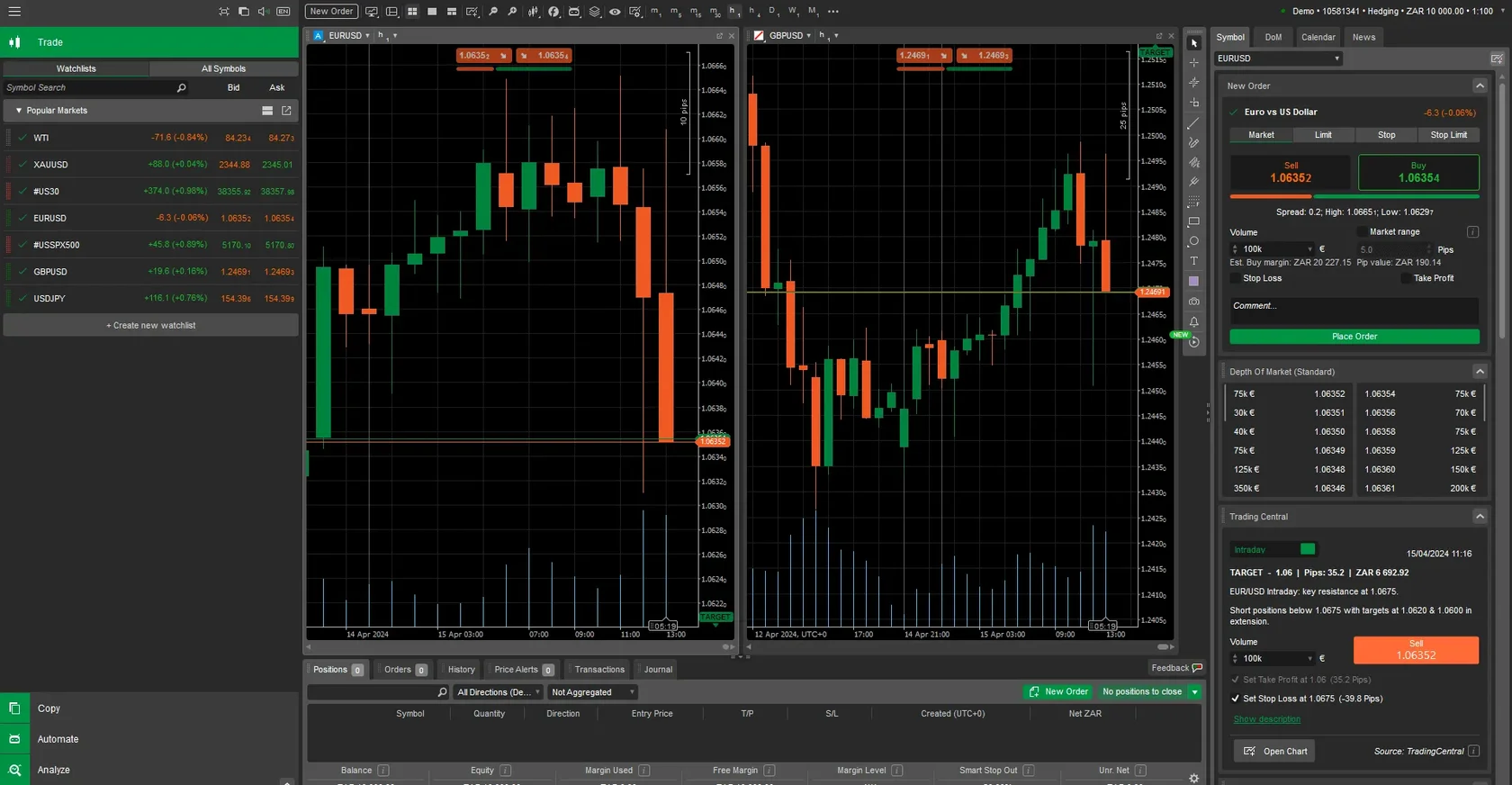

Our platform is engineered for intuitive use, streamlining stop loss implementation. Begin by accessing your preferred trading terminal within the FxPro client area. Navigate to the order placement window for your chosen instrument.

Locate the "Stop Loss" field within the order parameters. Enter your desired price level, using either an absolute value or a pip distance from the current market price. Our system instantly calculates the position risk based on your inputs.

Always confirm your order details before execution. Review the stop loss placement, position size, and potential loss amount. Click the execute button to activate your protected trade.

MetaTrader 4 Stop Loss Configuration

Right-click on your open position in the "Terminal" window and select "Modify or Delete Order." The modification dialog will display current parameters, including unrealized profit/loss. Input your stop loss price or simply drag the red stop loss line directly on the chart for precise visual placement. Click "Modify" to apply the setting.

| Platform Feature | MetaTrader 4 | MetaTrader 5 | cTrader |

|---|---|---|---|

| Minimum Stop Distance | 2-5 pips | 2-5 pips | 1-3 pips |

| Trailing Stop | Yes | Yes | Yes |

| Guaranteed Stops | Available | Available | Available |

| Visual Placement | Drag & Drop | Drag & Drop | Click & Set |

Mobile Application Stop Loss Management

Our FxPro mobile applications for iOS and Android deliver full stop loss functionality on the go. Access order modification features via the "Positions" tab. A simple touch-and-hold on an existing position reveals the modification options.

The mobile platform supports both manual price entry and chart-based stop placement, with pinch-to-zoom functionality enabling precise level selection. Push notifications alert you to stop loss executions, ensuring you're always informed, even when away from your desk.

Risk Management Calculations and Position Sizing

Proper stop loss placement demands accurate risk-to-reward calculations. Our platform provides built-in calculators to determine optimal position sizes based on your account balance and risk tolerance. Input your stop loss distance, and the system will automatically calculate the appropriate lot size.

Key risk management principles for traders:

- The 2% Rule: Never risk more than 1-2% of your account balance on a single trade.

- Volatility Awareness: Maintain stop loss distances appropriate for current market volatility.

- Use Calculators: Leverage position sizing calculators for consistent risk exposure.

- Monitor Correlation: Be aware of how multiple open positions are correlated to avoid compounding risk.

Common Stop Loss Mistakes and How to Avoid Them

Placing stops too close to an entry price is a classic error, often resulting in premature closure from normal market "noise." Use indicators like the Average True Range (ATR) to set more intelligent distances.

Another pitfall is emotional adjustment—moving a stop loss further away from your entry once a trade goes against you. This negates its purpose. Set your stop and respect it.

| Mistake Type | Impact | Solution |

|---|---|---|

| Too Tight Stops | Frequent, unnecessary stop-outs | Use ATR-based distances |

| No Stops Set | Unlimited, catastrophic risk | Make stop placement mandatory |

| Moving Stops to Widen Loss | Increased, uncontrolled losses | Adhere to your original trading plan |

| Round Number Stops | Predictable levels targeted by algorithms | Use technical analysis for placement |

Platform-Specific Stop Loss Features

MetaTrader 5 enhances stop loss functionality with partial close options, allowing you to modify stops on portions of a position. This is ideal for scaling out of trades.

The cTrader platform offers advanced visualization tools, such as heat maps that display stop loss clustering, helping you identify significant price levels based on order flow.

Our proprietary FxPro Edge platform integrates AI to suggest optimal stop placements by analyzing historical price patterns, volatility, and market conditions.

Regulatory Compliance and Stop Loss Requirements

For retail clients, financial regulations mandate negative balance protection. Our stop loss systems are a key part of this protection, ensuring account balances cannot fall below zero. Margin call procedures activate well before critical levels are reached.

Professional clients gain more flexibility and higher leverage, which demands an even more sophisticated approach to risk management. Our platform provides professional-grade tools while maintaining full regulatory compliance with bodies like the FSCA.

Advanced Stop Loss Optimization Techniques

For seasoned traders, optimizing stop loss placement is key. Consider volatility-adjusted stops using the ATR, or time-decay stops that tighten as a trade ages. The "How to Set Stop Loss on FxPro" process becomes second nature when you combine these advanced techniques with a solid understanding of the basics.

Our comprehensive stop loss implementation ensures robust risk management across all trading activities. These tools provide the foundation for sustainable trading success within the global financial markets.

Frequently Asked Questions (FAQ)

- What is a stop loss order on FxPro?

- A stop loss order is an automated instruction to close a trading position at a predetermined price to limit potential losses.

- Can I set stop losses on the FxPro mobile app?

- Yes, the FxPro mobile app offers full stop loss functionality, including manual entry, chart-based placement, and real-time notifications.

- What types of stop losses does FxPro offer?

- FxPro offers fixed, trailing, and guaranteed stop losses across its MetaTrader 4, MetaTrader 5, and cTrader platforms.

- How does leverage affect stop loss placement?

- Higher leverage amplifies both risk and potential reward, requiring tighter stop loss placement and smaller position sizes to maintain disciplined risk control.

- Are stop loss orders protected from slippage on FxPro?

- While standard stops can experience slippage in volatile markets, FxPro's Guaranteed Stop Loss Orders (GSLO) provide complete protection by executing at your exact price.