Table of Contents

- Understanding FxPro Account Limitations in South Africa

- Registration Process for Multiple Accounts

- Account Types and Their Specific Limitations

- Technical Implementation of Multiple Accounts

- Regulatory Compliance and Documentation

- Funding and Withdrawal Procedures

- Advanced Account Management Features

- Strategic Applications for Multiple Accounts

Understanding FxPro Account Limitations in South Africa

Our company allows South African traders to maintain multiple trading accounts under specific conditions. The standard policy permits up to 5 live trading accounts per individual client. This limitation ensures proper risk management and regulatory compliance within South African financial markets.

Each account requires separate verification procedures through our KYC (Know Your Customer) system. You must provide valid South African identification documents for every account registration. The process involves submitting your ID document, proof of residence, and bank statements dated within the last three months.

How Many FxPro Accounts Can You Have depends on your trading strategy and capital allocation needs. Professional traders often utilize multiple accounts for different trading approaches, currency pairs, or risk levels. Our platform supports this diversification strategy while maintaining strict regulatory oversight.

The verification timeline typically ranges from 24 to 72 hours for South African residents. Our compliance team reviews each application individually to ensure adherence to FSCA (Financial Sector Conduct Authority) regulations. This thorough process protects both our clients and our operational integrity.

Account Type Specifications:

| Account Type | Minimum Deposit (ZAR) | Maximum Accounts | Leverage Ratio |

|---|---|---|---|

| Standard | R1,000 | 3 | 1:30 |

| Professional | R10,000 | 5 | 1:500 |

| Islamic | R2,000 | 2 | 1:30 |

Registration Process for Multiple Accounts

Initial Account Setup Requirements

Creating your first FxPro account establishes your primary trading profile within our system. Navigate to our registration portal and select "Open Live Account" from the main menu. Complete the personal information section with your legal name, South African address, and contact details.

The system generates a unique client identifier linking all your future accounts. This identifier streamlines the verification process for subsequent account applications. Your primary account serves as the master profile for all trading activities and correspondence.

Upload high-resolution images of your South African ID document, driver's license, or passport. Ensure all document corners are visible and text remains clearly readable. Our automated verification system processes these documents within standard business hours.

Additional Account Application Steps

Submit separate applications for each additional trading account through your client portal. Access the "Account Management" section and select "Open Additional Account" option. Choose your preferred account type, base currency, and trading platform configuration.

Each application requires individual approval despite your existing client status. Our risk management team evaluates every new account against current market conditions and regulatory requirements. This process maintains compliance with South African financial regulations and international trading standards.

Required Documentation Checklist:

- Valid South African identification document

- Proof of residence (utility bill or bank statement)

- Bank account verification letter

- Employment confirmation or income proof

- Previous trading experience declaration

Account Types and Their Specific Limitations

Our platform offers distinct account categories designed for different trading approaches and experience levels. Standard accounts provide basic trading functionality with moderate leverage options suitable for retail traders. Professional accounts offer enhanced features including higher leverage ratios and advanced trading tools.

Islamic accounts comply with Sharia law principles, eliminating swap charges and interest-based transactions. These accounts maintain the same trading capabilities while adhering to religious requirements. South African Muslim traders can access all major currency pairs and commodities through this account type.

How Many FxPro Accounts Can You Have varies by category due to risk management protocols. Standard accounts allow up to 3 simultaneous positions per client. Professional accounts permit 5 active accounts with increased position sizing capabilities.

The segregation of account types prevents cross-contamination of trading strategies and risk profiles. Each account operates independently with separate margin requirements and position calculations. This structure enables sophisticated portfolio management techniques for experienced traders.

Account Feature Comparison:

| Feature | Standard | Professional | Islamic |

|---|---|---|---|

| Maximum Accounts | 3 | 5 | 2 |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Leverage | 1:30 | 1:500 | 1:30 |

| Swap-Free Trading | No | No | Yes |

| Advanced Tools | Basic | Full Access | Basic |

Technical Implementation of Multiple Accounts

Platform Integration and Management

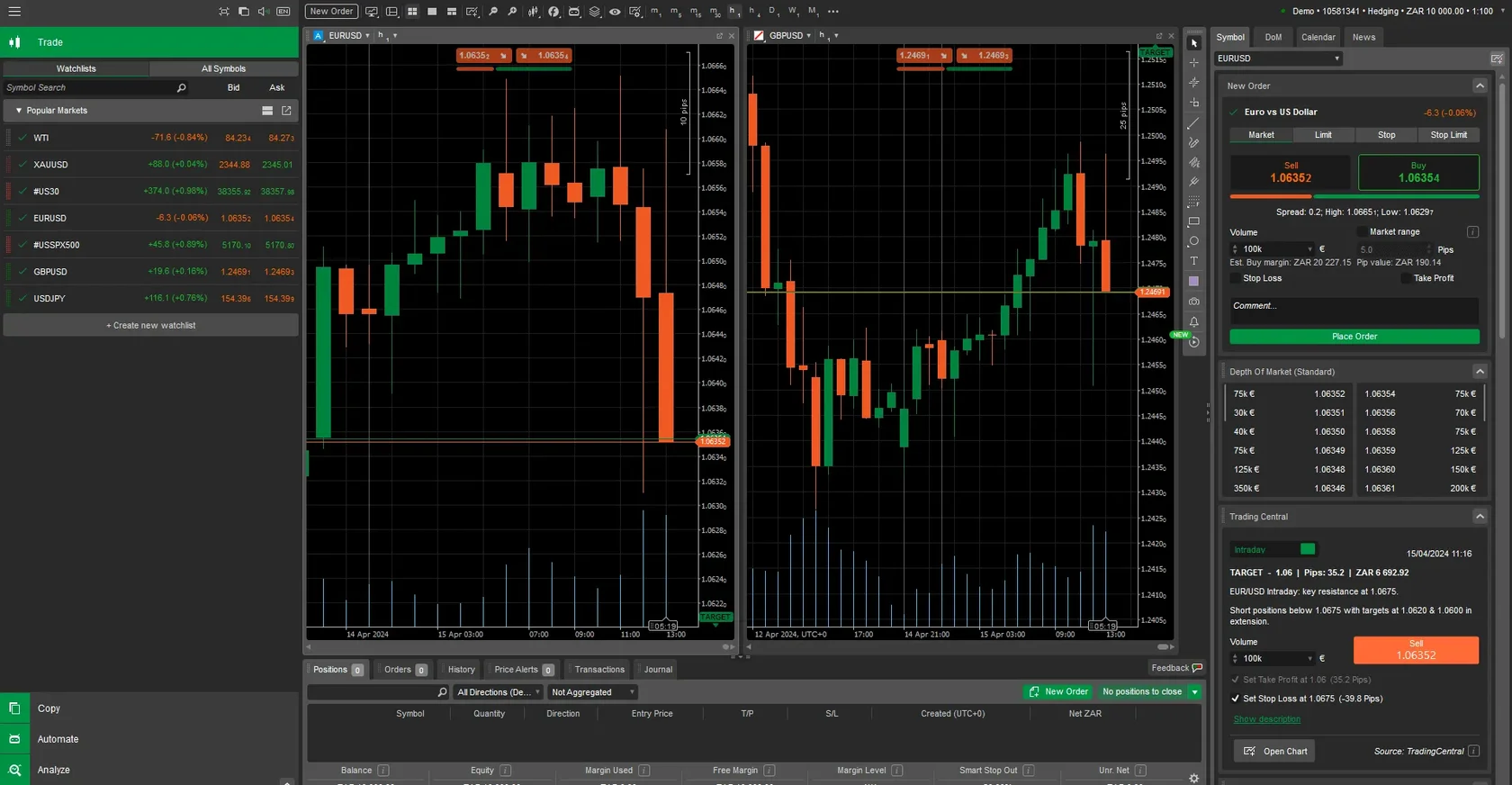

Our MetaTrader 4 and MetaTrader 5 platforms support simultaneous connections to multiple trading accounts. Download separate platform instances for each account or utilize the multi-account management features within single installations. Each account maintains independent login credentials and trading environments.

The cTrader platform offers advanced multi-account functionality through its institutional features. Professional traders can monitor all accounts simultaneously using customizable dashboard layouts. Position sizing, risk management, and order execution operate independently across all connected accounts.

Access your account management portal through our secure web interface using your primary login credentials. The dashboard displays all active accounts with real-time balance information, open positions, and performance metrics. Switch between accounts instantly without additional authentication procedures.

Risk Management Across Multiple Accounts

Implement position sizing strategies that account for total exposure across all trading accounts. Our risk management system calculates aggregate exposure while maintaining individual account margin requirements. This approach prevents over-leveraging while maximizing trading opportunities.

Set individual stop-loss and take-profit levels for each account based on specific trading strategies. The platform executes orders independently, allowing different risk tolerances and trading approaches simultaneously. Monitor correlation between positions to avoid unintended hedging or excessive concentration.

Risk Management Tools:

- Individual account margin monitoring

- Aggregate exposure calculations

- Automated position sizing controls

- Cross-account correlation analysis

- Real-time risk metric updates

Regulatory Compliance and Documentation

South African financial regulations require comprehensive documentation for multiple trading accounts. The FSCA mandates detailed record-keeping for all trading activities, position histories, and account transactions. Our compliance system automatically generates required reports for regulatory submissions.

Maintain separate tax documentation for each trading account to ensure accurate financial reporting. South African tax authorities treat each account as a distinct trading entity for capital gains calculations. Consult with qualified tax professionals regarding multiple account implications for your specific situation.

How Many FxPro Accounts Can You Have depends partly on your ability to maintain proper documentation standards. Our system provides detailed transaction histories, profit/loss statements, and regulatory reports for each account. Download these documents monthly to maintain comprehensive trading records.

The verification process for additional accounts includes enhanced due diligence procedures. Our compliance team may request additional documentation including source of funds declarations and trading experience questionnaires. This thorough approach ensures full regulatory compliance and client protection.

Compliance Documentation Timeline:

| Document Type | Submission Deadline | Renewal Period |

|---|---|---|

| Identity Verification | Account Opening | 2 Years |

| Address Proof | Account Opening | 6 Months |

| Income Verification | Account Opening | 1 Year |

| Trading Experience | Account Opening | Annual Update |

Funding and Withdrawal Procedures

Multi-Account Funding Strategies

Fund each trading account separately using South African banking methods including EFT transfers, credit cards, and electronic wallets. Our payment processing system recognizes the source account for each deposit, ensuring proper allocation to designated trading accounts. Processing times range from instant for card payments to 24 hours for bank transfers.

Implement systematic funding approaches that align with your trading strategy for each account. Consider using different funding sources for various account types to maintain clear separation of trading capital. This approach simplifies accounting procedures and enhances risk management capabilities.

The minimum funding requirements vary by account type, with standard accounts requiring R1,000 and professional accounts needing R10,000 initial deposits. Subsequent deposits can be smaller amounts, allowing flexible capital allocation across multiple accounts. Our system processes all deposits in South African Rand to eliminate currency conversion fees.

Withdrawal Management Systems

Process withdrawals from each account independently using the same payment method used for deposits. Our anti-money laundering protocols require withdrawal destinations to match verified funding sources. This security measure protects client funds while maintaining regulatory compliance.

Withdrawal processing times depend on the selected method and account verification status. Bank transfers typically complete within 1-3 business days for South African accounts. Electronic wallet withdrawals process within 24 hours for verified accounts with complete documentation.

Withdrawal Processing Schedule:

- Bank transfers: 1-3 business days

- Credit card refunds: 3-5 business days

- Electronic wallets: 24 hours

- International transfers: 3-7 business days

- Cryptocurrency: 1-2 hours (where available)

Advanced Account Management Features

Our proprietary account management system provides comprehensive oversight tools for multiple trading accounts. Access real-time performance analytics, risk metrics, and correlation analysis through the unified dashboard interface. These tools enable sophisticated portfolio management techniques across all your trading accounts.

Utilize automated reporting features to track performance across all accounts simultaneously. Generate detailed profit/loss statements, drawdown analysis, and risk-adjusted returns for individual accounts or combined portfolios. Export data in various formats including CSV, PDF, and Excel for external analysis.

How Many FxPro Accounts Can You Have becomes less relevant when you can efficiently manage multiple accounts through our advanced tools. The platform calculates aggregate statistics while maintaining individual account integrity. This approach supports complex trading strategies requiring multiple execution venues.

Configure custom alerts and notifications for each account based on specific criteria including margin levels, profit targets, and risk thresholds. The system sends notifications via email, SMS, or push notifications to mobile devices. Customize alert frequencies to avoid information overload while maintaining adequate monitoring.

Advanced Management Tools:

| Tool Category | Features | Availability |

|---|---|---|

| Performance Analytics | ROI, Sharpe Ratio, Drawdown | All Accounts |

| Risk Management | VaR, Correlation, Exposure | Professional Only |

| Automated Reporting | P&L, Tax Reports, Statements | All Accounts |

| Alert Systems | Custom Triggers, Multi-Channel | All Accounts |

Strategic Applications for Multiple Accounts

Professional traders utilize multiple accounts for strategy segregation, allowing distinct approaches for different market conditions. Allocate one account for scalping strategies, another for swing trading, and a third for long-term position holding. This separation prevents strategy interference and enables accurate performance measurement.

Implement currency-specific accounts to trade particular regional markets or currency pairs. Focus one account on major pairs (EUR/USD, GBP/USD), another on exotic pairs, and a third on commodity currencies. This specialization approach enhances expertise development and risk management capabilities.

Consider using separate accounts for different risk tolerance levels, with conservative strategies in one account and aggressive approaches in another. This method allows portfolio diversification while maintaining clear risk boundaries. Monitor correlation between accounts to ensure true diversification benefits.

The multi-account structure supports systematic trading approaches including algorithmic strategies, copy trading, and manual execution methods. Deploy automated systems on dedicated accounts while maintaining manual trading capabilities on others. This hybrid approach maximizes trading opportunities while controlling technological risks.

Our platform supports these advanced strategies through robust infrastructure and comprehensive management tools. The system maintains account independence while providing unified oversight capabilities. This balance enables sophisticated trading approaches suitable for professional and institutional clients in South Africa.

FAQ

- How many FxPro accounts can I have in South Africa?

- You can have up to 5 live accounts depending on the account types you choose and regulatory compliance.

- Is separate verification required for each FxPro account?

- Yes, each account requires individual KYC verification with valid South African documentation.

- Can I use multiple accounts for different trading strategies?

- Yes, multiple accounts enable diversification of trading strategies and risk management.

- What are the minimum deposits for different FxPro account types?

- Standard accounts require R1,000, Professional accounts R10,000, and Islamic accounts R2,000 as minimum deposits.

- How long does account verification take?

- Verification for South African residents typically takes between 24 and 72 hours.