Key Takeaways

- Identify peak trading sessions on FxPro perfectly aligned with South African time zones (SAST).

- Capitalize on session overlaps to trade with higher liquidity and volatility.

- Master FxPro's platform tools for superior risk management and economic calendar alerts.

Table of Contents

- Decoding FxPro's Global Trading Sessions from South Africa

- Pinpointing Peak Trading Hours for South African FxPro Users

- Strategic Timing for Major Currency Pairs on FxPro

- Market Volatility and When is the Best Time to Trade on FxPro

- Integrating the Economic Calendar for Precision Timing

- Capitalizing on Session Overlap Trading Opportunities

- How Technology and Execution Speed Impact Your Trades

- Advanced Risk Management Across Different Trading Sessions

Decoding FxPro's Global Trading Sessions from South Africa

As a trader in South Africa, you gain direct access to the global forex market's 24-hour cycle through the FxPro platform. The market is segmented into four major sessions: Sydney, Tokyo, London, and New York, each offering unique characteristics and opportunities.

Your strategic advantage lies in South Africa's time zone (SAST, GMT+2). This positions you perfectly to engage with the highly active European and American sessions during your regular business hours. Our robust trading infrastructure ensures seamless, high-speed execution across all these sessions.

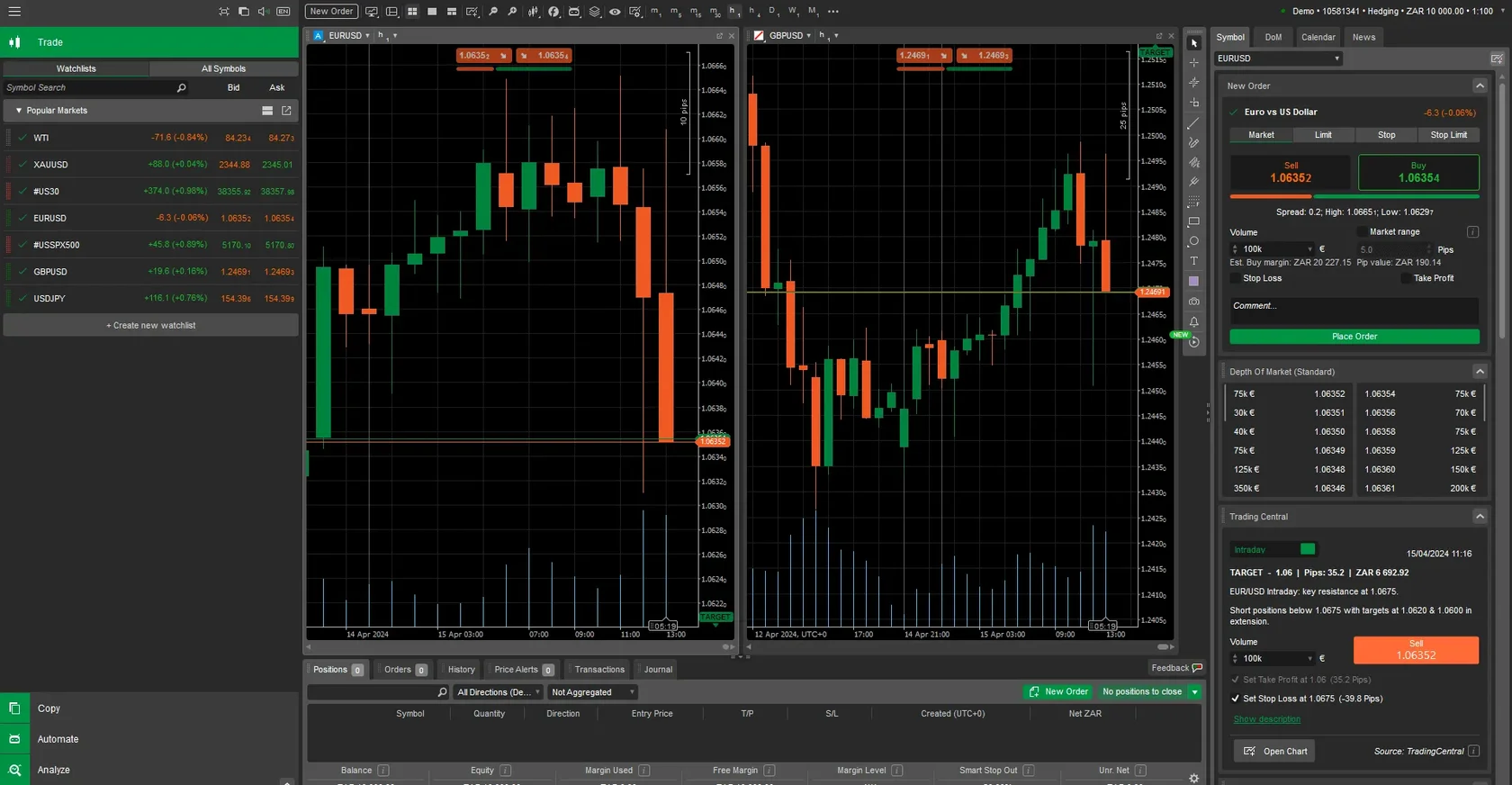

The answer to when is the best time to trade on FxPro ultimately depends on your chosen currency pairs and tolerance for market volatility. Major pairs like EUR/USD, GBP/USD, and USD/JPY ignite with activity during session overlaps. The FxPro platform provides real-time volatility indicators to help you pinpoint optimal entry and exit points with confidence.

| Trading Session | SAST Time | Peak Activity | Major Pairs |

|---|---|---|---|

| Sydney | 00:00-09:00 | AUD/USD, NZD/USD | Low-Medium |

| Tokyo | 02:00-11:00 | USD/JPY, EUR/JPY | Medium |

| London | 10:00-19:00 | EUR/USD, GBP/USD | High |

| New York | 15:00-00:00 | USD/CAD, USD/CHF | High |

Pinpointing Peak Trading Hours for South African FxPro Users

The most potent period for trading occurs when the London session overlaps with the New York session. This window, from 15:00 to 19:00 SAST, generates the highest trading volume, creating the most liquid and opportunity-rich environment. During these hours, our platform processes a maximum number of transactions, ensuring exceptionally tight spreads and minimal slippage.

The European Session Advantage

With European markets opening at 10:00 SAST, you can actively manage your portfolio during your standard workday. The FxPro mobile app keeps you connected with real-time notifications for price movements and order executions. The EUR/USD, for instance, hits its peak volatility during London hours, presenting numerous trading setups.

The American Session Advantage

The New York session kicks off at 15:00 SAST, extending your trading day into the evening. USD-denominated pairs experience a surge in volatility, and our platform's advanced charting tools are designed to help you identify the powerful breakout patterns common at the start of this session.

Strategic Timing for Major Currency Pairs on FxPro

Different currency pairs have distinct personalities and peak activity times. FxPro's integrated market analysis tools are essential for identifying the optimal timing for your specific pairs. As a rule, major pairs offer the most favorable trading conditions during their home market sessions.

EUR/USD, the world's most traded pair, peaks during the London-New York overlap (15:00-19:00 SAST). This four-hour window delivers maximum liquidity and the tightest spreads. Our execution engine processes orders in milliseconds, making it ideal for strategies like scalping that thrive on precision and speed.

GBP/USD follows a similar pattern but often with greater volatility. The "Cable" can make sharp, decisive moves at the London open (10:00 SAST). Our built-in risk management tools can automatically calculate your position size based on these volatility characteristics.

- EUR/USD: Peak activity 15:00-19:00 SAST

- GBP/USD: High volatility 10:00-19:00 SAST

- USD/JPY: Active during 02:00-11:00 and 15:00-00:00 SAST

- AUD/USD: Best during 00:00-09:00 SAST

- USD/CAD: Optimal 15:00-00:00 SAST

Market Volatility and When is the Best Time to Trade on FxPro

Understanding when is the best time to trade on FxPro is synonymous with analyzing market volatility patterns. The FxPro platform grants you access to extensive historical volatility data, enabling you to align your trading times with your personal risk appetite.

Monday mornings frequently exhibit price gaps due to news events over the weekend. Our platform's gap analysis tools help you identify these potential trading opportunities. Gaps formed during the Asian session often tend to close during European hours, creating predictable price patterns.

Weekly Trading Rhythm

Tuesday through Thursday typically present the most stable and consistent trading conditions. Our data confirms these days have an optimal balance of volatility without excessive unpredictability. Be aware that Friday afternoons can see reduced liquidity as large institutions close out their weekly positions.

| Time Period | Volatility Level | Trading Recommendation | Risk Level |

|---|---|---|---|

| Monday 00:00-10:00 | Variable | Gap trading | High |

| Tuesday-Thursday | Optimal | All strategies | Medium |

| Friday 19:00+ | Declining | Position closing | Low-Medium |

| Month-end | Elevated | Flow trading | High |

Integrating the Economic Calendar for Precision Timing

The FxPro platform features a comprehensive, built-in economic calendar. This indispensable tool displays upcoming news events, rated by their potential market impact. As a South African trader, you can strategically plan your trades around major economic releases with ease.

High-impact events, such as US employment data (15:30 SAST on the first Friday of the month) or ECB press conferences (14:45 SAST), are clearly marked. Our calendar automatically adjusts all event times to your local SAST time zone, removing any guesswork.

News trading demands precision execution. FxPro's one-click trading feature allows for rapid order placement during these volatile moments, while pre-set stop-loss orders are crucial for protecting your capital against adverse price spikes.

Capitalizing on Session Overlap Trading Opportunities

Session overlaps are the powerhouse of the forex market, creating periods of intense liquidity. For South African users, the London-New York overlap (15:00-19:00 SAST) represents the ultimate trading window. Our liquidity aggregation technology ensures you receive the most competitive pricing during these peak times.

The London-New York Overlap Strategy

This four-hour window boasts maximum trading volume and the tightest available spreads. Major currency pairs often carve out their entire daily range during this period. FxPro's advanced order types, such as limit and stop orders, empower you to execute complex strategies in these dynamic conditions.

Breakout strategies are particularly effective during session overlaps. You can use our suite of technical analysis tools to identify key support and resistance levels, and even deploy automated trading systems (EAs) to execute your strategy flawlessly when a price break occurs.

How Technology and Execution Speed Impact Your Trades

The FxPro platform is built on an advanced technology infrastructure designed for optimal execution timing. With servers strategically located in global financial hubs, we minimize latency for our South African traders, ensuring orders are processed in microseconds, even during peak volatility.

Execution quality is paramount. Our best execution policy guarantees competitive pricing across all sessions, while the platform's smart order routing technology automatically seeks out the best liquidity sources for your trade in real-time.

Your network connectivity can affect trading performance. That's why our platform includes connection monitoring tools that show you real-time latency data. This transparency allows you to trade with full confidence in your connection's stability.

Advanced Risk Management Across Different Trading Sessions

Knowing when is the best time to trade on FxPro also involves mastering the unique risk profile of each session. Our platform provides session-specific risk metrics, helping you intelligently adjust your position sizes. Volatility can vary dramatically between the Asian, European, and American sessions.

The Asian session typically exhibits lower volatility and tighter trading ranges. Conservative traders often favor these hours for their steady price action. Our risk management tools can help you set appropriate stop-loss levels tailored to these conditions.

Conversely, the European and American sessions demand a more dynamic approach to risk due to higher volatility. The FxPro position sizing calculator can incorporate session-specific volatility data, and dynamic stop-loss orders can adjust automatically as market conditions evolve.

- Asian hours: Consider tighter stops, potentially with larger position sizes.

- European hours: Employ standard risk parameters.

- American hours: Use wider stops and potentially smaller position sizes to account for volatility.

- News events: Reduce leverage and implement protective stop orders.

Our automated risk management system constantly monitors your total exposure, while real-time margin monitoring prevents over-leveraging during volatile periods, giving you a safety net for your trading capital.

FAQ

- When is the best time to trade EUR/USD on FxPro in South Africa?

- The absolute best time is during the London-New York session overlap, between 15:00 and 19:00 SAST. This is when you'll find the highest liquidity and volatility, offering the most trading opportunities.

- How does FxPro help manage risk during volatile sessions?

- FxPro offers a suite of powerful tools, including session-specific risk metrics, a position size calculator, dynamic stop-loss orders, and news impact indicators to help you precisely manage your risk and leverage.

- Are there automated tools for trading during session overlaps?

- Yes, FxPro fully supports the use of advanced order types and automated trading systems (Expert Advisors). You can deploy predefined strategies to automatically capitalize on opportunities during volatile session overlaps.