Table of Contents

- Introduction to FxPro Services in South Africa

- Understanding What Does Rollover Mean in FxPro

- Forex Trading Features on FxPro

- CFD Trading Capabilities on FxPro

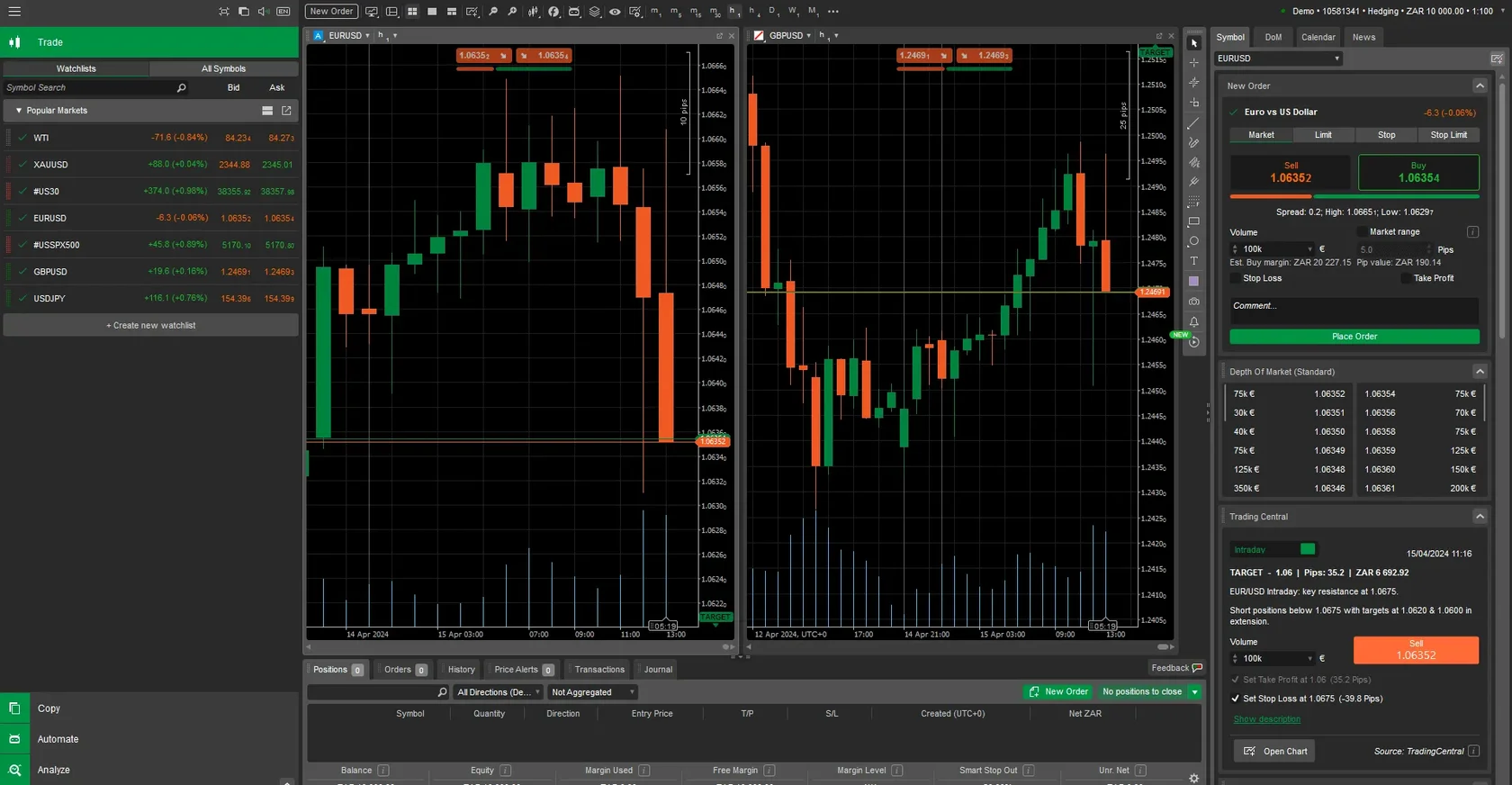

- How to Use the FxPro Platform Effectively

- Technical Specifications and System Requirements

- Fees, Bonuses, and Execution Details

- Safety, Regulations, and Support in South Africa

Introduction to FxPro Services in South Africa

FxPro offers both forex and CFD trading services tailored for South African clients. Our platform provides access to currency pairs, indices, commodities, and real-time market data. We serve traders with precise execution speeds and comprehensive instruments. Clients in South Africa can trade using ZAR as their base currency. The platform supports multiple order types and advanced trading tools to enhance trading efficiency.

Our company operates with a focus on transparent pricing and leveraged trading up to 1:200 for forex instruments. South African traders benefit from localized support and payment methods compatible with regional banking systems. FxPro integrates advanced technology to ensure smooth trading experiences. We continue to adapt our services to meet the regulatory standards of South Africa.

| Service Type | Available Instruments | Max Leverage |

|---|---|---|

| Forex | Major, Minor, Exotic pairs | 1:200 |

| CFD | Indices, Commodities, Shares | 1:200 |

| Both | Combination of Forex and CFD | Dependent on instrument |

Understanding What Does Rollover Mean in FxPro

In FxPro, rollover refers to the process of extending the settlement date of an open position to the next trading day. This is important for both forex and CFD traders in South Africa as it impacts position costs. Rollover involves interest rate differentials between two currencies or underlying assets. The fee or credit is automatically applied to your account at 23:59 server time, which corresponds to 01:59 SAST in South Africa. Knowing what does rollover mean in FxPro helps you manage overnight holdings effectively.

Factors Affecting Rollover Calculation

- Interest Rate Differentials: The difference between interest rates of the currencies involved.

- Position Size: Larger positions result in proportionally higher rollover fees or credits.

- Instrument Type: Forex pairs and CFDs have distinct rollover mechanisms.

Our system calculates rollover automatically and updates it daily on trading accounts. South African traders can check rollover charges via the trading platform’s instrument specification section. Rollover fees are transparent and reflected in the account history for full clarity.

Forex Trading Features on FxPro

FxPro provides access to over 70 forex currency pairs, including majors, minors, and exotics. Spreads start from 0.6 pips on major pairs with no requotes. We offer leverage up to 1:200 on forex instruments for South African traders, allowing enhanced exposure with managed risk. Our platform supports instant execution and market execution order types.

Accessing Forex Markets

To trade forex on FxPro, log into your account and select the 'Forex' tab. Use the search function to find currency pairs. Click on a pair to open the trading window where you can set your lot size, stop loss, and take profit levels. Confirm the order to execute instantly or place a pending order as desired.

Trading Tools for Forex

- MetaTrader 4 and 5: Full support with advanced charting and automated trading.

- FxPro Edge: Proprietary platform with integrated risk management tools.

- Economic Calendar: Real-time updates for forex-related events impacting pricing.

CFD Trading Capabilities on FxPro

FxPro offers CFDs on indices such as the JSE Top 40 and commodities including gold, oil, and silver. Real-time quotes ensure South African traders receive accurate pricing. Our platform supports leveraged CFD trading with a maximum of 1:200. We provide both market and pending order types with no requotes on CFDs.

How to Trade CFDs

Access the 'CFD' section in the FxPro interface, then select your preferred asset. Use the order form to set volume and price triggers. Confirm trades to open positions instantly. Positions can be managed via the portfolio tab where stop loss and take profit orders are adjustable.

| Asset Class | Example Instruments | Spread Range |

|---|---|---|

| Indices | JSE Top 40, FTSE 100 | 0.5 - 1.5 points |

| Commodities | Gold, Brent Oil, Silver | 0.3 - 1.2 points |

| Shares (CFD) | Major global stocks | Variable, per stock |

CFD Trading Features

- Real-time Pricing: Direct feed with minimal latency.

- Stop and Limit Orders: Protect positions and automate exits.

- Mobile Access: Full CFD functionality on iOS and Android apps.

How to Use the FxPro Platform Effectively

FxPro supports multiple platforms including MetaTrader 4, MetaTrader 5, and FxPro Edge. For South African traders, each platform offers specific functionalities. MetaTrader platforms support custom indicators and expert advisors. FxPro Edge provides web-based trading with integrated analytics. Registering on FxPro requires a valid South African ID and proof of address.

Step-by-Step Trading Process

- Register and Verify: Complete KYC by uploading documents.

- Deposit Funds: Use South African-friendly methods such as EFT or credit cards.

- Select Market: Choose forex or CFDs from the market list.

- Place Order: Specify volume, price, and order type.

- Manage Positions: Adjust stop loss/take profit or close trades anytime.

Our platform supports ZAR deposits and withdrawals with processing times typically under 24 hours. The interface allows quick switching between instruments and portfolio overview. Alerts and notifications can be configured for price levels and news events affecting your trades.

Technical Specifications and System Requirements

FxPro platforms are compatible with Windows 7 or higher, macOS 10.13+, iOS 12+, and Android 7+. Our web-based FxPro Edge requires the latest versions of Chrome, Firefox, or Edge browsers. Minimum internet speed of 2 Mbps is recommended for smooth real-time data feeds. Platforms support FIX API for institutional clients and MT4/MT5 APIs for automated trading.

Supported Formats and Standards

- Order Types: Market, Limit, Stop, Stop Limit, Trailing Stop.

- Data Feeds: Real-time streaming via proprietary servers.

- Charting: Multiple timeframes, technical indicators, drawing tools.

Limitations include maximum single order size of 50 lots for forex and 100 lots for CFDs. Margin calls are triggered at 50% equity and stop out at 20%. South African traders can use multi-currency accounts with ZAR, USD, EUR supported. Our platform provides 24/5 uptime with scheduled maintenance notified in advance.

| Platform | Supported OS | Key Features |

|---|---|---|

| MetaTrader 4 | Windows, macOS, iOS, Android | Expert Advisors, Indicators, Alerts |

| MetaTrader 5 | Windows, macOS, iOS, Android | Advanced Order Types, Depth of Market |

| FxPro Edge | Web-based (Chrome, Firefox, Edge) | Integrated Analytics, Portfolio Management |

Fees, Bonuses, and Execution Details

FxPro charges spreads starting from 0.6 pips on forex majors with no commission on standard accounts. For CFDs, spreads vary by instrument and are displayed clearly in the platform. Execution speed averages 11.06 milliseconds on our ECN servers. We provide rollover rates daily, visible in the contract specifications. South African clients receive a welcome bonus applicable to first deposits, subject to terms.

Fee Structure

- Forex Spreads: From 0.6 pips on EUR/USD and GBP/USD.

- CFD Spreads: Variable according to asset class.

- Swap/Rollover Fees: Calculated daily based on position and interest rates.

Deposit and withdrawal fees depend on payment method but are generally free for local transfers. Our company implements no hidden fees or extra charges. Execution is guaranteed without requotes using our advanced liquidity aggregation technology.

Safety, Regulations, and Support in South Africa

FxPro is regulated by multiple authorities including the FCA and CySEC. While not regulated locally in South Africa, we comply with international standards and provide transparent operations. Client funds are segregated in top-tier banks and protected through negative balance protection. Support in South Africa is available via email, live chat, and phone during local business hours from 08:00 to 17:00 SAST.

Customer Assistance

- Local Language Support: English-speaking agents familiar with South African market.

- Account Management: Dedicated managers for premium clients.

- Educational Resources: Webinars, tutorials, and market analysis.

Our security protocols include two-factor authentication and SSL encryption for all data transmissions. Clients can monitor and limit access to their accounts easily via the FxPro client portal. We continuously update our compliance to reflect changes in South African financial regulations.

| Feature | Details |

|---|---|

| Regulation | FCA, CySEC, FSCA pending |

| Client Fund Protection | Segregated Accounts, Negative Balance Protection |

| Support Hours | 08:00 - 17:00 SAST, Mon-Fri |

FAQ

- What Does Rollover Mean in FxPro?

- Rollover is the automatic extension of an open trade position to the next trading day, including applicable swap fees or credits.

- Is FxPro regulated in South Africa?

- FxPro is regulated internationally and complies with global standards; South African regulation is pending, but client funds are secure.

- Which platforms can South African traders use?

- MetaTrader 4, MetaTrader 5, and FxPro Edge are fully supported for clients in South Africa.

- How fast is FxPro’s trade execution?

- Average execution speed is approximately 11 milliseconds on ECN servers.

- Can I trade both forex and CFDs with FxPro?

- Yes, we provide comprehensive access to both forex currency pairs and CFD instruments.